Growing Awareness and Patient Advocacy

There is a notable increase in awareness regarding biologic therapies among patients and healthcare professionals in China. Patient advocacy groups are playing a crucial role in educating the public about the benefits of biologic treatments for various conditions. This heightened awareness is leading to greater demand for biologic therapies, as patients seek effective alternatives to traditional treatments. The biologic therapy market is experiencing a shift in patient preferences, with more individuals opting for biologics due to their targeted mechanisms of action and improved outcomes. Surveys indicate that approximately 60% of patients are now more informed about biologic options compared to five years ago. This trend is expected to continue, as ongoing educational campaigns and support networks further empower patients to make informed treatment choices.

Technological Advancements in Biologics

Technological innovations in biologic therapies are transforming the landscape of treatment options available in China. Advances in biotechnology, including monoclonal antibodies and gene therapies, are enhancing the efficacy and safety profiles of biologic products. The biologic therapy market is witnessing a surge in the development of biosimilars, which offer cost-effective alternatives to expensive biologics. As of 2025, the market for biosimilars in China is projected to reach approximately $3 billion, reflecting a growing acceptance among healthcare providers and patients. These advancements not only improve patient outcomes but also expand access to biologic therapies, thereby driving market growth. Furthermore, the integration of digital health technologies, such as telemedicine and mobile health applications, is facilitating better patient management and adherence to biologic treatments.

Government Support and Policy Initiatives

The Chinese government is actively promoting the biologic therapy market through various policy initiatives and funding programs. The National Health Commission has implemented strategies aimed at enhancing the accessibility and affordability of biologic treatments. This includes subsidies for research and development, as well as streamlined approval processes for new biologic products. The biologic therapy market is benefiting from these supportive measures, which are designed to foster innovation and improve healthcare outcomes. In 2025, government investments in the biopharmaceutical sector are expected to exceed $10 billion, further stimulating market growth. Additionally, the emphasis on improving healthcare infrastructure and expanding insurance coverage for biologic therapies is likely to enhance patient access, thereby driving demand in the market.

Increasing Prevalence of Chronic Diseases

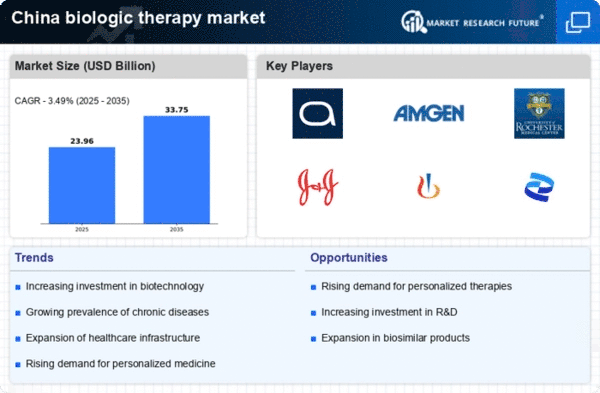

The rising incidence of chronic diseases in China is a pivotal driver for the biologic therapy market. Conditions such as cancer, diabetes, and autoimmune disorders are becoming more prevalent, necessitating advanced treatment options. According to recent health statistics, chronic diseases account for approximately 80% of all deaths in China, highlighting the urgent need for effective therapies. Biologic therapies, known for their targeted action and efficacy, are increasingly being adopted as first-line treatments. This trend is expected to propel the market forward, as healthcare providers seek innovative solutions to manage these complex conditions. The biologic therapy market is thus positioned to grow significantly, with projections indicating a compound annual growth rate (CAGR) of around 15% over the next five years, driven by the demand for effective chronic disease management.

Rising Investment in Biopharmaceutical Research

Investment in biopharmaceutical research is on the rise in China, significantly impacting the biologic therapy market. Both public and private sectors are channeling funds into the development of innovative biologic therapies. In 2025, it is estimated that biopharmaceutical research funding will reach approximately $15 billion, reflecting a strong commitment to advancing healthcare solutions. This influx of capital is facilitating the exploration of new biologic candidates and enhancing clinical trial capabilities. The biologic therapy market is poised to benefit from this trend, as increased research efforts lead to the discovery of novel therapies that address unmet medical needs. Furthermore, collaborations between academic institutions and pharmaceutical companies are fostering a robust ecosystem for biopharmaceutical innovation, potentially accelerating the introduction of new biologic products into the market.