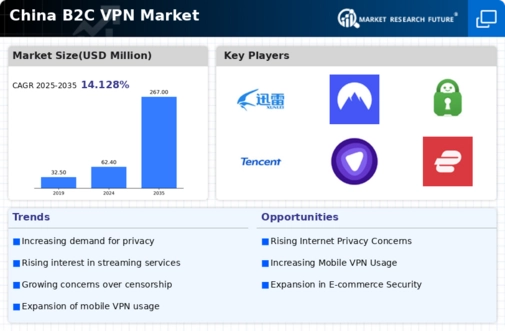

The competitive dynamics of the B2C VPN market in China are characterized by a blend of innovation, strategic partnerships, and a focus on user privacy. Key growth drivers include increasing internet censorship, a rising demand for online privacy, and the expansion of digital services. Major players such as ExpressVPN (GB), NordVPN (GB), and Surfshark (NL) are actively shaping the competitive landscape through their distinct operational focuses. For instance, ExpressVPN (GB) emphasizes robust security features and user-friendly interfaces, while NordVPN (GB) has been investing in advanced encryption technologies to enhance user trust. Surfshark (NL), on the other hand, is leveraging its competitive pricing strategy to attract a broader user base, indicating a multifaceted approach to market positioning.

The business tactics employed by these companies reflect a moderately fragmented market structure, where localized strategies and supply chain optimization play crucial roles. Companies are increasingly localizing their services to cater to the unique regulatory environment in China, which may involve partnerships with local firms to navigate compliance challenges. This collective influence of key players fosters a competitive environment that encourages innovation while addressing the specific needs of Chinese consumers.

In December 2025, ExpressVPN (GB) announced a partnership with a leading cybersecurity firm to enhance its security protocols, a move that underscores its commitment to user privacy and data protection. This strategic action is likely to bolster its market position by appealing to privacy-conscious consumers, thereby reinforcing its brand reputation in a highly competitive landscape. Furthermore, this partnership may serve as a benchmark for other players in the market, highlighting the importance of security in consumer decision-making.

In November 2025, NordVPN (GB) launched a new feature aimed at improving connection speeds and reliability, which is particularly relevant in the context of increasing internet restrictions in China. This initiative not only enhances user experience but also positions NordVPN (GB) as a leader in technological innovation within the market. By focusing on performance, the company appears to be addressing a critical consumer pain point, potentially attracting users who prioritize speed alongside security.

In October 2025, Surfshark (NL) introduced a subscription model that allows users to access multiple devices simultaneously, catering to the growing trend of multi-device usage among consumers. This strategic move is indicative of Surfshark's understanding of consumer behavior and its ability to adapt to changing market demands. By offering flexible subscription options, Surfshark (NL) may enhance customer loyalty and retention, further solidifying its competitive edge.

As of January 2026, the B2C VPN market is witnessing trends such as digitalization, AI integration, and a heightened focus on sustainability. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in enhancing service offerings. The shift from price-based competition to a focus on innovation and technology is evident, with companies striving to differentiate themselves through advanced features and reliable service. Looking ahead, competitive differentiation is likely to evolve, emphasizing the importance of technological advancements and supply chain reliability as key factors in attracting and retaining consumers.