Evolving Business Ecosystems

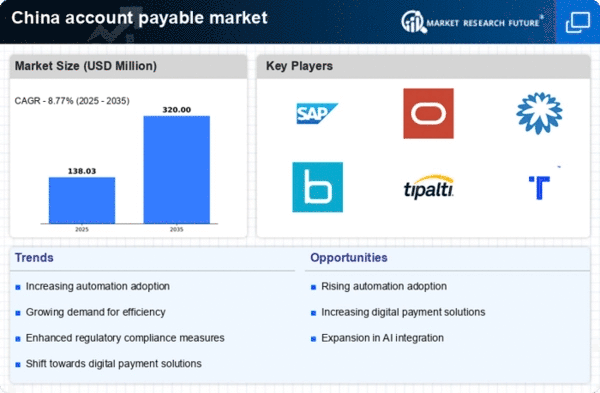

The account payable market in China is significantly influenced by the evolving business ecosystems characterized by increased collaboration among various stakeholders. As companies seek to optimize their supply chains, partnerships with fintech firms are becoming more prevalent. This collaboration allows for the development of tailored solutions that address specific needs within the account payable processes. Moreover, the rise of e-commerce has led to a surge in transaction volumes, with estimates suggesting a growth rate of 20% annually. This dynamic environment necessitates agile account payable systems that can adapt to changing demands, thereby driving innovation and efficiency in the market.

Regulatory Landscape Changes

The account payable market in China is navigating a complex regulatory landscape that is continuously evolving. Recent changes in financial regulations are compelling businesses to enhance their compliance measures, particularly concerning tax reporting and anti-money laundering protocols. Companies are investing in compliance technologies to ensure adherence to these regulations, which can incur costs but ultimately safeguard against potential penalties. The market is expected to see a rise in demand for solutions that facilitate compliance, with estimates indicating a growth of 15% in related services over the next few years. This regulatory focus is reshaping operational strategies within the account payable market.

Increased Focus on Cost Management

In the current economic climate, the account payable market in China is witnessing an increased focus on cost management strategies. Companies are actively seeking ways to reduce operational expenses and improve their bottom lines. This trend is reflected in the growing adoption of automated solutions, which can lead to cost savings of up to 25% in processing fees. Additionally, organizations are prioritizing vendor negotiations to secure better payment terms, which can enhance cash flow. As businesses strive to maintain competitiveness, the emphasis on cost management is likely to shape the future landscape of the account payable market.

Shift Towards Sustainable Practices

Sustainability is becoming a pivotal driver in the account payable market in China, as businesses increasingly recognize the importance of environmentally responsible practices. Companies are adopting green procurement policies, which influence their payment processes and supplier relationships. This shift is not only about compliance but also about enhancing brand reputation and customer loyalty. Research indicates that organizations implementing sustainable practices can experience a 10% increase in customer retention. As the demand for transparency in sustainability efforts grows, the account payable market is likely to evolve, integrating sustainability metrics into payment processes and supplier evaluations.

Technological Advancements in Payment Processing

The account payable market in China is experiencing a notable transformation due to rapid technological advancements in payment processing. Innovations such as blockchain and artificial intelligence are streamlining operations, enhancing efficiency, and reducing costs. For instance, the integration of AI-driven solutions is projected to reduce processing times by up to 30%, thereby improving cash flow management for businesses. Furthermore, the adoption of mobile payment platforms is on the rise, with over 70% of transactions in urban areas being conducted via mobile devices. This shift not only facilitates quicker payments but also enhances transparency and security in transactions, which is crucial for the account payable market.