Rising Demand for Smart Cities

The push towards smart city initiatives in China is significantly driving the 5G IoT Market. Urbanization has led to increased population density, necessitating the implementation of smart solutions to enhance urban living. The integration of IoT devices in smart city projects is expected to optimize resource management, improve public safety, and enhance transportation systems. For instance, the Chinese government aims to invest around $1.5 trillion in smart city development by 2030, which will likely create a substantial demand for 5G-enabled IoT applications. This trend indicates a growing recognition of the potential benefits of interconnected devices in urban environments, thereby propelling the 5g iot market forward.

Government Initiatives and Support

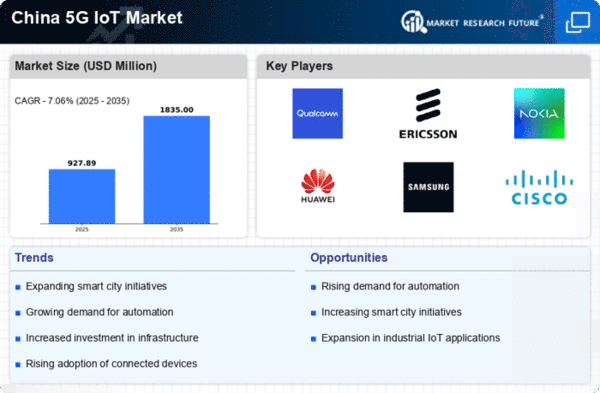

The 5G IoT Market in China is experiencing a surge due to robust government initiatives aimed at promoting digital transformation. The Chinese government has allocated substantial funding, estimated at over $100 billion, to enhance telecommunications infrastructure and support the deployment of 5G technology. This investment is expected to facilitate the integration of IoT devices across various sectors, including manufacturing, healthcare, and transportation. Furthermore, regulatory frameworks are being established to streamline the adoption of IoT solutions, thereby fostering innovation and attracting foreign investments. As a result, the 5g iot market is likely to witness accelerated growth, with projections indicating a compound annual growth rate (CAGR) of approximately 30% over the next five years.

Consumer Electronics and Smart Home Devices

The proliferation of consumer electronics and smart home devices is significantly influencing the 5G IoT Market in China. As consumers increasingly seek convenience and connectivity, the demand for smart home solutions is on the rise. Products such as smart thermostats, security systems, and home automation devices are becoming commonplace. The market for smart home devices in China is expected to exceed $50 billion by 2026, driven by advancements in 5G technology that enable seamless integration and communication between devices. This trend suggests that as more households adopt smart technologies, the 5g iot market will likely expand, creating new opportunities for manufacturers and service providers.

Industrial Automation and Smart Manufacturing

The 5G IoT Market is being propelled by the increasing adoption of industrial automation and smart manufacturing practices in China. As industries strive for greater efficiency and productivity, the integration of IoT devices powered by 5G technology is becoming essential. The manufacturing sector, which contributes approximately 30% to China's GDP, is witnessing a transformation with the implementation of smart factories. These facilities utilize real-time data analytics and machine-to-machine communication to optimize operations. Reports suggest that the market for industrial IoT in China could reach $200 billion by 2025, indicating a strong correlation between industrial advancements and the growth of the 5g iot market.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in China is a critical driver for the 5G IoT Market. With the rollout of 5G networks across urban and rural areas, connectivity is becoming more reliable and widespread. This infrastructure development is essential for supporting the vast number of IoT devices expected to be deployed in various sectors. As of November 2025, China has reportedly established over 1 million 5G base stations, facilitating enhanced data transmission speeds and lower latency. This robust network infrastructure is likely to encourage businesses to adopt IoT solutions, thereby stimulating growth in the 5g iot market. The anticipated increase in connected devices is projected to reach 1 billion by 2030.