Expansion of Smart Cities

The development of smart cities in China is significantly influencing the 5g customer-premises-equipment market. As urban areas increasingly adopt smart technologies, the demand for robust 5G connectivity becomes paramount. Smart city initiatives require advanced customer-premises equipment to support applications such as IoT devices, autonomous vehicles, and real-time data analytics. Reports indicate that investments in smart city projects could exceed $300 billion by 2025, creating a substantial market opportunity for 5g customer-premises-equipment. This trend suggests a symbiotic relationship between urban development and the growth of the 5g customer-premises-equipment market.

Rising Consumer Expectations

The 5G Customer-Premises-Equipment Market in China is experiencing a surge in consumer expectations for faster and more reliable internet connectivity. As digital lifestyles evolve, consumers demand seamless streaming, gaming, and remote work capabilities. This shift is driving the need for advanced customer-premises equipment that can support high-speed 5G networks. According to recent data, approximately 70% of Chinese consumers express a preference for 5G services over 4G, indicating a clear market trend. This growing expectation compels manufacturers to innovate and enhance their offerings, thereby propelling the 5g customer-premises-equipment market forward.

Increased Mobile Data Consumption

The rapid increase in mobile data consumption in China is a critical driver for the 5g customer-premises-equipment market. With the proliferation of smartphones and mobile applications, data traffic is projected to grow by over 50% annually. This surge necessitates the deployment of advanced customer-premises equipment capable of handling higher data volumes and providing enhanced user experiences. As consumers increasingly rely on mobile devices for various activities, the demand for efficient 5G solutions is likely to escalate, thereby propelling the 5g customer-premises-equipment market.

Government Initiatives and Support

The Chinese government plays a pivotal role in the growth of the 5g customer-premises-equipment market through various initiatives and policies aimed at promoting 5G technology. Substantial investments in infrastructure development and regulatory support are evident, with the government allocating over $20 billion to enhance 5G network deployment. These initiatives not only facilitate the expansion of 5G networks but also encourage local manufacturers to develop competitive customer-premises equipment. As a result, the 5g customer-premises-equipment market is likely to benefit from increased production capabilities and improved technology standards.

Competitive Landscape and Innovation

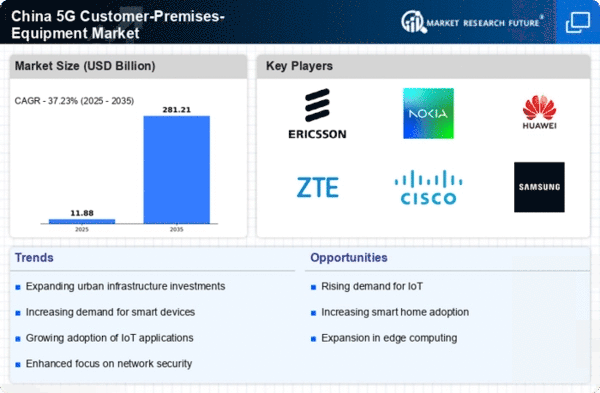

The competitive landscape within the 5g customer-premises-equipment market in China is characterized by rapid innovation and technological advancements. Major players are investing heavily in research and development to create cutting-edge equipment that meets the evolving needs of consumers and businesses. This competitive environment fosters a culture of innovation, leading to the introduction of new features and capabilities in customer-premises equipment. As companies strive to differentiate themselves, the 5g customer-premises-equipment market is expected to witness continuous growth driven by these innovations.