Market Share

Cheminformatics Market Share Analysis

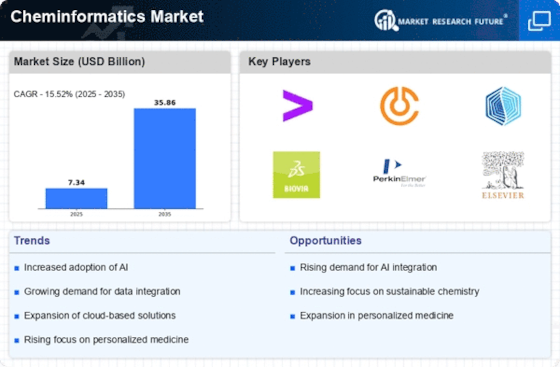

The Cheminformatics market, a vital component of the pharmaceutical and biotechnology sectors, has witnessed dynamic growth in recent years. Companies operating in this domain are employing various market share positioning strategies to stay competitive and capitalize on emerging opportunities. To capture a larger market share, many Cheminformatics firms are focusing on diversifying their product portfolios. This involves the development of a wide range of software solutions and tools that cater to different aspects of drug discovery, chemical analysis, and molecular modeling. Some companies in the field of Cheminformatics are focusing on a small market approach. They work hard to target certain areas like personalized medicine, computer chemistry or harmful substances. By learning a lot about these small areas, businesses want to show they're the best in those places. This helps them have an advantage over others. Understanding that Chemistry and Information Technology work together, businesses are making deals and joining forces. These partnerships often include sharing things like resources, knowledge and tools to make products better. They also help reach more people in the markets. Firms can offer complete solutions and attract more customers by using each other's strong points. Many businesses in the field of Cheminformatics are working hard to grow around the world. This means going into new areas on the map, being seen in growing money places and changing things to fit what's needed where. Businesses try to get into different markets so they sell more and don't just rely on one area. To stay ahead in the fast-changing field of Cheminformatics, firms are putting lots of money into research and development. This investment makes sure products get better all the time and new, clever solutions arrive on time. It helps companies stay ahead of others in their market so they can bring in more customers. Good companies that work with Cheminformatics are really caring about what their customers need and want. By putting the customer first, businesses can make things better for users. This lets them give special answers and stay friends with people for a long time to come. This plan not only keeps current customers but also brings in new ones through good rumors and referrals. Understanding different needs of their customers, Cheminformatics businesses are giving options to change and grow solutions. This allows users to change the software according to their own job routines and sizes. This makes sure they have a more tailored experience that fits them best. Companies can become trustworthy for the long run by giving their clients answers that can change as those needs grow. Building a strong brand presence is crucial in the competitive Cheminformatics market. Companies are investing in robust marketing strategies to create brand awareness and establish themselves as industry leaders. This includes participation in conferences, workshops, and other industry events to showcase their expertise and innovations. Recognizing the importance of user proficiency, many Cheminformatics companies are investing in training programs and customer support services. This ensures that users can maximize the benefits of the software solutions, leading to higher customer satisfaction and loyalty. Companies that prioritize ongoing support are likely to attract and retain a larger customer base.

Leave a Comment