North America : Market Leader in Chemical Supply Chain

North America is poised to maintain its leadership in the Chemical Supply Chain Management market, holding a significant market share of 8.2 in 2024. Key growth drivers include robust industrial activity, technological advancements, and a strong regulatory framework that promotes sustainability. The demand for innovative chemical solutions is on the rise, driven by sectors such as automotive, pharmaceuticals, and consumer goods, which are increasingly focusing on efficiency and environmental compliance.

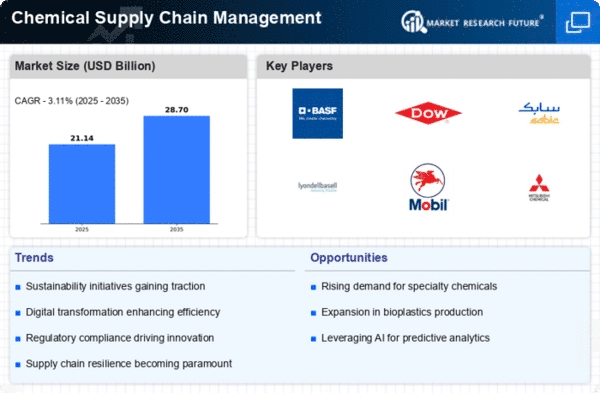

The competitive landscape is characterized by major players like Dow, ExxonMobil Chemical, and LyondellBasell, who are investing heavily in R&D to enhance their supply chain capabilities. The U.S. remains the largest market, supported by a well-established infrastructure and a skilled workforce. Additionally, the presence of leading companies fosters a dynamic environment for collaboration and innovation, ensuring that North America continues to be a pivotal region in the global chemical supply chain.

Europe : Innovation and Sustainability Focus

Europe's Chemical Supply Chain Management market is valued at 5.5, reflecting a strong emphasis on innovation and sustainability. The region is witnessing a shift towards greener practices, driven by stringent regulations and consumer demand for eco-friendly products. The European Union's Green Deal and REACH regulations are pivotal in shaping market dynamics, encouraging companies to adopt sustainable practices and invest in cleaner technologies.

Leading countries such as Germany, France, and the Netherlands are at the forefront of this transformation, with key players like BASF and Covestro leading the charge. The competitive landscape is marked by a mix of established firms and innovative startups, all striving to enhance supply chain efficiency. The focus on digitalization and automation is also gaining traction, positioning Europe as a hub for cutting-edge chemical supply chain solutions.

Asia-Pacific : Emerging Market with Growth Potential

The Asia-Pacific region, with a market size of 5.0, is rapidly emerging as a key player in Chemical Supply Chain Management. The growth is fueled by increasing industrialization, urbanization, and rising demand for chemicals in various sectors, including construction, automotive, and electronics. Governments are also implementing favorable policies to attract foreign investment, further driving market expansion.

Countries like China, Japan, and India are leading the charge, with significant investments in infrastructure and technology. Major companies such as Mitsubishi Chemical and Ineos are expanding their operations in the region, enhancing their supply chain capabilities. The competitive landscape is evolving, with both multinational corporations and local players vying for market share, making Asia-Pacific a dynamic and competitive environment for chemical supply chain management.

Middle East and Africa : Resource-Rich with Growth Challenges

The Middle East and Africa region, valued at 1.8, presents a unique landscape for Chemical Supply Chain Management, characterized by abundant natural resources and a growing demand for chemicals. The region is witnessing increased investments in petrochemical industries, driven by the need for diversification and economic development. However, challenges such as political instability and infrastructure deficits can hinder growth.

Countries like Saudi Arabia and South Africa are leading the market, with key players such as SABIC and local firms expanding their operations. The competitive landscape is gradually evolving, with a focus on enhancing supply chain efficiency and sustainability. As the region continues to develop its chemical sector, opportunities for growth and collaboration are emerging, positioning it as a potential hub for chemical supply chain activities.