Growth in Water and Wastewater Treatment

The increasing focus on water and wastewater treatment is a significant driver for the Global Chemical Injection Metering Pumps and Valves Market Industry. As urbanization accelerates and water scarcity becomes a pressing issue, governments and organizations are investing heavily in infrastructure to ensure clean water supply and effective wastewater management. Chemical injection metering pumps are essential for accurately dosing treatment chemicals, thus enhancing the efficiency of purification processes. This growing emphasis on sustainable water management practices is likely to propel the market forward, with a projected increase in demand as municipalities and industries seek reliable solutions for their treatment needs.

Increasing Demand for Process Automation

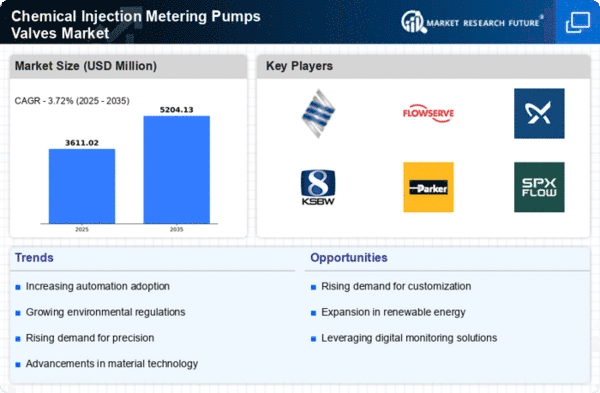

The Global Chemical Injection Metering Pumps and Valves Market Industry is experiencing a notable surge in demand for process automation across various sectors, including oil and gas, water treatment, and chemical manufacturing. This trend is driven by the need for enhanced efficiency, accuracy, and safety in chemical dosing applications. As industries increasingly adopt automated solutions, the market is projected to reach 3.48 USD Billion in 2024, reflecting a growing reliance on advanced metering technologies. The integration of smart technologies and IoT in chemical injection systems further supports this demand, enabling real-time monitoring and control, which is essential for optimizing operational performance.

Rising Oil and Gas Exploration Activities

The resurgence of oil and gas exploration activities globally is a key factor influencing the Global Chemical Injection Metering Pumps and Valves Market Industry. As energy demands escalate, companies are investing in advanced extraction techniques, which often require precise chemical dosing for enhanced recovery processes. Metering pumps are integral to these operations, ensuring accurate chemical injection for processes such as enhanced oil recovery and pipeline maintenance. The increasing investments in the oil and gas sector are anticipated to drive market growth, as companies seek reliable and efficient metering solutions to optimize production and reduce operational costs.

Regulatory Compliance and Environmental Concerns

Stringent regulatory frameworks and heightened environmental awareness are pivotal drivers in the Global Chemical Injection Metering Pumps and Valves Market Industry. Governments worldwide are implementing regulations to minimize environmental impact and ensure safe chemical handling. This regulatory landscape compels industries to adopt reliable metering solutions that comply with safety standards. For instance, the introduction of regulations regarding wastewater treatment and chemical discharge has led to increased investments in metering technologies. As a result, the market is expected to grow significantly, with projections indicating a rise to 5.21 USD Billion by 2035, as companies prioritize compliance and sustainability in their operations.

Technological Advancements in Metering Solutions

Technological innovation plays a crucial role in shaping the Global Chemical Injection Metering Pumps and Valves Market Industry. The development of advanced materials, precision engineering, and digital technologies has led to the creation of more efficient and reliable metering solutions. Innovations such as smart pumps equipped with sensors and data analytics capabilities enhance operational efficiency and reduce maintenance costs. These advancements not only improve the accuracy of chemical dosing but also contribute to the overall safety of chemical processes. As industries continue to embrace these technologies, the market is projected to witness a compound annual growth rate (CAGR) of 3.73% from 2025 to 2035, indicating robust growth prospects.