Ceramic Coating Size

Ceramic Coating Market Growth Projections and Opportunities

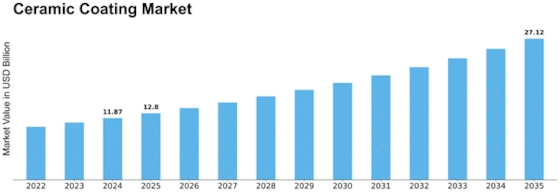

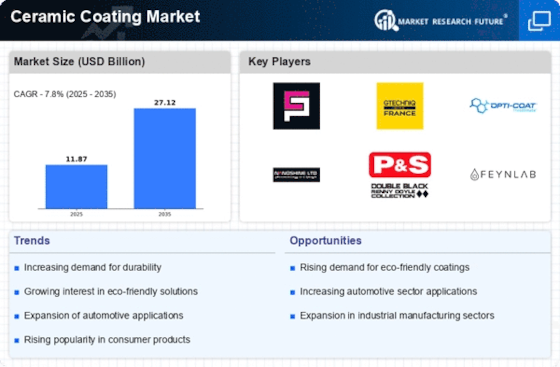

The global ceramic coatings market is experiencing a noteworthy surge, anticipated to grow at a CAGR of 5.22% and potentially reach a value of USD 12,594.0 million by the end of the projected period. Volume-wise, the market size hit 1,428.2 kilotons in 2019 and is expected to escalate to 1,844.6 kilotons, exhibiting a CAGR of 4.27%.

One of the key driving forces in this surge is the burgeoning demand from the automotive sector. With an increasing emphasis on reducing carbon footprint, along with the swift adoption of electric vehicles, there's a growing need for ceramic coatings. Additionally, the aerospace and defense industries are major contributors to this market due to the expansion of commercial aviation networks, the flourishing tourism sector, economic growth, and heightened air travel.

The onset of the COVID-19 pandemic notably highlighted the utility of ceramic coatings, particularly in the healthcare realm. These coatings have seen increased use in healthcare settings. Moreover, their application in the energy and power sector, especially in solar and wind energy, has further stimulated market growth during this evaluation period.

However, certain drawbacks linked with the use of ceramic coatings hinder the market's growth trajectory.

The global ceramic coatings market is meticulously analyzed based on material type, technology, and end-use industry. Material types encompass oxide, silica, alumina-magnesia, carbide, nitride, and others. Notably, the oxide segment, valued at USD 2,307.7 million in 2019, holds a prominent position in the market. It serves as an undercoating in various protective products like varnishes, paints, and greasepaints. Moreover, their relatively lower cost compared to other materials has propelled their demand in the market.

The global ceramic coatings market is divided based on technology into chemical vapor deposition, physical vapor deposition, thermal spray, and other methods. Notably, the physical vapor deposition segment has shown remarkable growth, boasting a robust CAGR of 5.85% during the review period. This surge can be attributed to the manifold advantages of physical vapor deposition coatings, such as enhanced hardness, reduced friction, and improved resistance to oxidation.

Furthermore, the market is segmented by end-use industry, encompassing automotive, oil & gas, aerospace & defense, chemical, textile, energy & power, healthcare, and other sectors. In 2019, the automotive segment held more than a 25% share of the global market and displayed a CAGR of 5.35%. The swift adoption of electric vehicles, which utilize ceramic coatings in batteries, is projected to be a significant driver for market growth in this segment.

The global ceramic coatings market extends across five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Among these regions, Asia-Pacific took the lead, accounting for over 45% of the market share in 2019. This region is expected to showcase the highest CAGR of 6.56% during the review period. The substantial growth here can be attributed to rapid industrial expansion and the improved economic conditions of consumers across various industries in this region.

Leave a Comment