Adoption of Advanced Lysis Technologies

The Cell Lysis and Disruption Market is increasingly characterized by the adoption of advanced lysis technologies, which are designed to improve efficiency and yield in cellular disruption processes. Innovations such as microfluidics, ultrasonic lysis, and enzymatic methods are gaining traction among researchers and manufacturers. These technologies not only enhance the extraction of cellular components but also reduce processing times and costs. As industries seek to streamline their operations and improve productivity, the demand for these advanced lysis solutions is likely to grow. This trend indicates a promising future for the Cell Lysis and Disruption Market, as it adapts to the evolving needs of various sectors, including pharmaceuticals, biotechnology, and academic research.

Increasing Focus on Genomics and Proteomics

The Cell Lysis and Disruption Market is witnessing a heightened focus on genomics and proteomics, which are critical fields in modern biological research. As the demand for high-throughput analysis of genetic material and proteins escalates, the need for efficient cell lysis techniques becomes paramount. The Cell Lysis and Disruption is projected to exceed 62 billion USD by 2026, reflecting a growing interest in personalized medicine and targeted therapies. This trend suggests that the Cell Lysis and Disruption Market will play a crucial role in supporting these initiatives by providing innovative lysis solutions that enhance the efficiency and accuracy of genomic and proteomic studies.

Rising Research Activities in Biotechnology

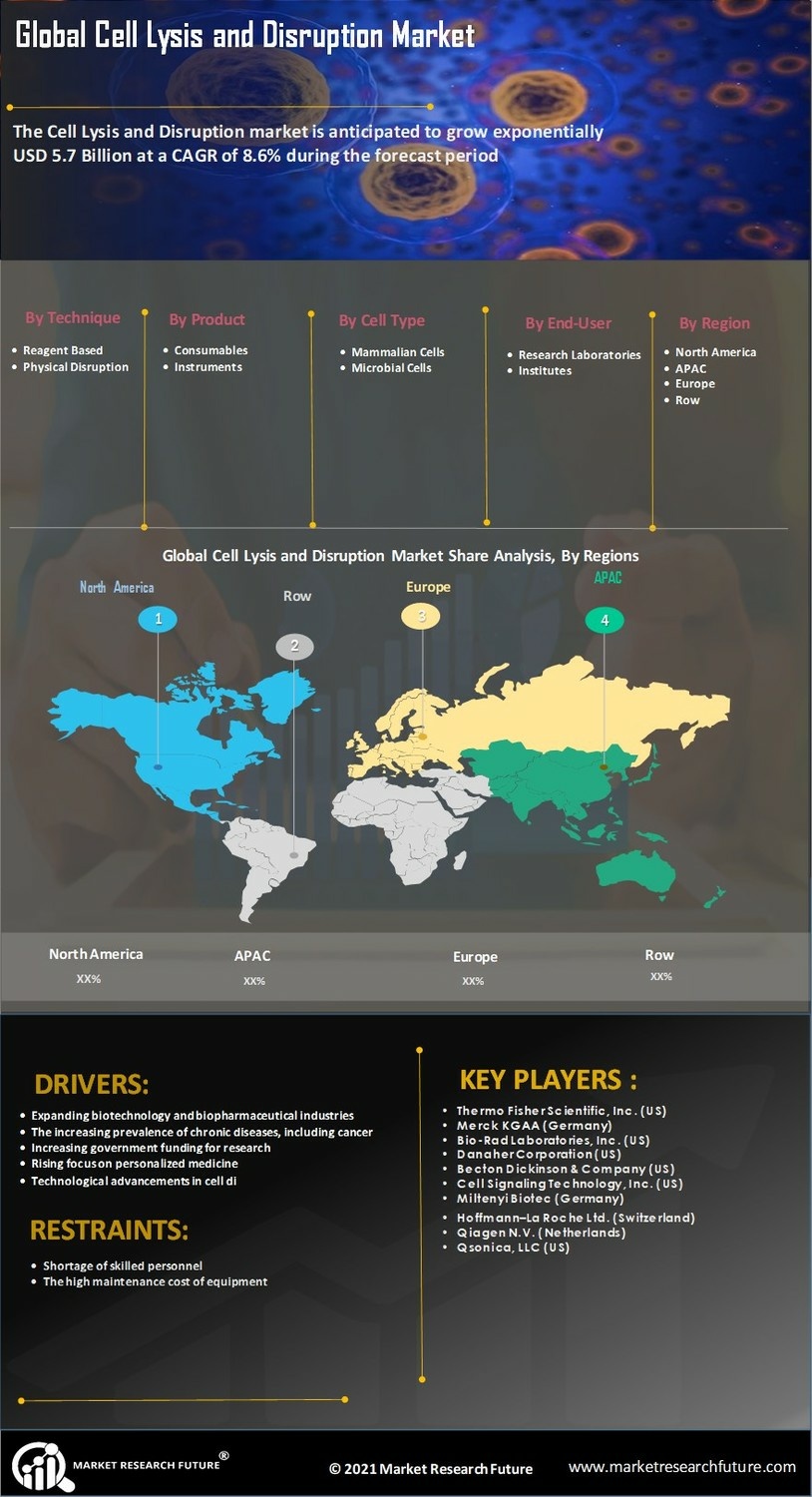

The Cell Lysis and Disruption Market is experiencing a surge in research activities, particularly within biotechnology sectors. This increase is driven by the need for advanced methodologies to extract cellular components for various applications, including drug development and genetic research. According to recent data, the biotechnology sector is projected to grow at a compound annual growth rate of approximately 7.4% over the next five years. This growth is likely to enhance the demand for efficient cell lysis techniques, as researchers seek to optimize their workflows and improve yield. Consequently, the Cell Lysis and Disruption Market stands to benefit from this trend, as innovative lysis solutions become essential for meeting the evolving needs of researchers and developers in the field.

Growing Applications in Environmental and Food Testing

The Cell Lysis and Disruption Market is expanding its reach into environmental and food testing applications, where the need for accurate analysis of microbial content is critical. As regulatory standards become more stringent, the demand for reliable lysis methods to detect pathogens and contaminants in food and environmental samples is increasing. This trend is supported by the rising awareness of food safety and environmental health, prompting industries to invest in advanced testing technologies. The market for food safety testing is projected to grow significantly, which may drive the demand for effective cell lysis solutions. Thus, the Cell Lysis and Disruption Market is likely to benefit from this diversification, as it provides essential tools for ensuring compliance and safety in these sectors.

Expansion of Pharmaceutical and Biopharmaceutical Industries

The Cell Lysis and Disruption Market is significantly influenced by the expansion of pharmaceutical and biopharmaceutical industries. As these sectors continue to grow, driven by increasing investments in drug discovery and development, the demand for effective cell lysis methods is expected to rise. The biopharmaceutical market alone is anticipated to reach a valuation of over 500 billion USD by 2026, indicating a robust growth trajectory. This expansion necessitates the use of advanced lysis technologies to facilitate the extraction of proteins, nucleic acids, and other biomolecules from cells. Therefore, the Cell Lysis and Disruption Market is poised to capitalize on this growth, providing essential tools and solutions to support the burgeoning pharmaceutical landscape.