Catalyst Regeneration Market Summary

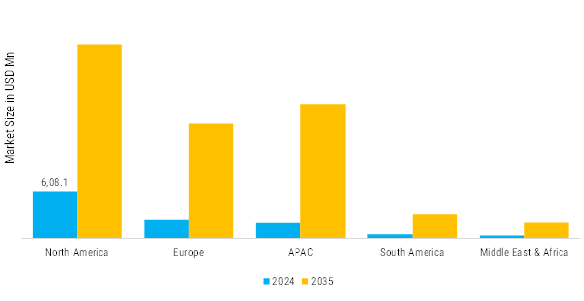

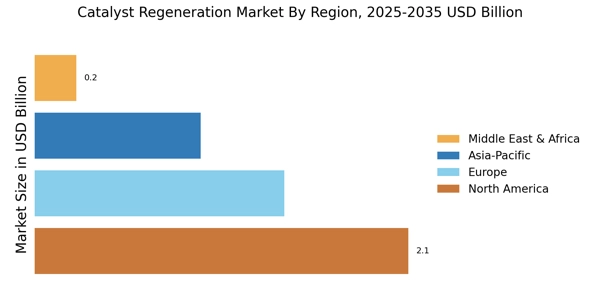

As per Market Research Future analysis, the Catalyst Regeneration Market Size was valued at USD 5,708.24 million in 2024. The Catalyst Regeneration Industry is projected to grow from USD 5,994.82 million in 2025 to USD 10,922.14 million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Catalyst Regeneration Market exhibits several key trends shaped by sustainability demands, technological innovations, and industrial expansion.

- Innovations in regeneration methods dominate the market, enhancing catalyst performance and lifespan. Advanced thermal regeneration techniques offer precise temperature control, while chemical and catalytic cleaning processes reduce deactivation more effectively than traditional approaches.

- Sustainability integrates deeply, with regeneration slashing raw material needs by 70-90% compared to virgin catalysts. Industries target net-zero goals, favoring eco-friendly processes that lower CO2 footprints from catalyst production.

- Petrochemicals and refining account for 70% of demand, with hydro processing catalysts regenerating most frequently due to high deactivation rates.

- Renewable energy applications surge, including biomass-to-fuels and green hydrogen electrolysis catalysts.

- Automotive exhaust systems trend toward regenerable three-way catalysts amid EV transitions, while pharmaceuticals explore enzyme-mimetic regenerations. Industrial modernization, like FCC unit upgrades, heightens service needs.

Market Size & Forecast

| 2024 Market Size | 5,708.24 (USD Million) |

| 2035 Market Size | 10,922.14 (USD Million) |

| CAGR (2025 - 2035) | 6.2% |

Major Players

Sinopec Catalyst Co., Ltd., BASF SE, Chevron Phillips Chemical Company, LyondellBasell Industries Holdings B.V., SABIC, Honeywell International Inc., Shell Plc, Johnson Matthey Plc, Clariant Ag, IFP Energies Nouvelles, Dow Inc., Axens, ExxonMobil Corporation, Haldor Topsoe A/S, Albemarle Corporation, Others.