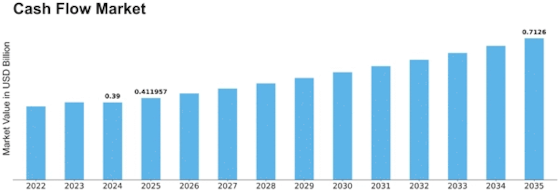

Cash Flow Size

Cash Flow Market Growth Projections and Opportunities

Cash flow market course is determined by numerous factors. The business climate matters. GDP growth, inflation, and unemployment impact the cash flow market. Strong economies boost commercial activity, which helps corporations save cash. However, economic downturns may reduce spending and company investment, hurting cash flows. Market factors like interest rates affect cash flow. Central bank interest rates affect how much consumers and companies pay to borrow money. Lower interest rates help firms acquire inexpensive finance, encouraging growth and spending. High-interest rates may make borrowing money more costly, slowing economic development and corporate cash flow. Field competitiveness might also affect cash flow concerns. Market rivalry may raise prices, reducing earnings and cash flow. If they can't differentiate their products or services, companies in competitive marketplaces may struggle to maintain cash flows. Government policies and norms greatly impact financial market openness. Tax, trade, and industry norms might affect a business's cash flow. Tax or trade legislation changes might affect organizations' finances and cash flow. People's actions affect the cash flow market, particularly in enterprises that rely on client spending. Changing consumer habits, preferences, and trends may alter demand for products and services, affecting organizations' revenue and cash flow. Businesses must adapt to shifting client preferences to maintain cash flow.

Currency value is another market issue that may affect cash flow. This is particularly true for international firms. Foreign exchange rates determine how much raw materials cost and how much you gain selling completed items, affecting cash flow and profit margins. Global companies must manage financial risks to maintain cash flow.

The cash flow market may also be impacted by investor confidence and market mood. Businesses' cash flows improve when consumers feel well and spend and invest more. Bad sentiments or not knowing how much money they have might cause consumers to cut down on purchases and spending, hurting cash flow. A cash flow company is always evolving with new ideas and technologies. New technology may boost efficiency, save expenses, and boost cash flow. However, firms that don't adapt to technology may struggle to compete and maintain cash flow.

Leave a Comment