North America : Leading Market Innovators

North America is poised to maintain its leadership in the Cargo Ship Maintenance and Overhaul Services Market, holding a market share of 15.0 in 2024. The region's growth is driven by increasing maritime trade, stringent safety regulations, and advancements in ship technology. The demand for efficient maintenance services is further fueled by the aging fleet and the need for compliance with environmental standards.

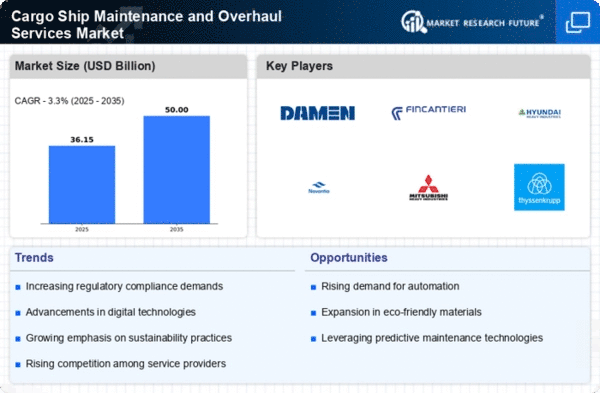

The United States and Canada are the primary players in this market, with significant investments in shipyards and maintenance facilities. Key players such as Damen Shipyards Group and Wärtsilä Corporation are enhancing their service offerings to meet the growing demand. The competitive landscape is characterized by a focus on innovation and sustainability, ensuring that North America remains a hub for maritime services.

Europe : Regulatory Framework and Growth

Europe, with a market size of 10.5, is a significant player in the Cargo Ship Maintenance and Overhaul Services Market. The region benefits from a robust regulatory framework that emphasizes safety and environmental sustainability. The European Union's regulations on emissions and ship safety are driving demand for advanced maintenance services, ensuring compliance and enhancing operational efficiency.

Leading countries such as Germany, Italy, and the Netherlands are home to major shipyards and maintenance facilities. Companies like Fincantieri S.p.A. and Thyssenkrupp Marine Systems are at the forefront, leveraging technological advancements to improve service delivery. The competitive landscape is marked by collaboration between shipbuilders and service providers, fostering innovation and efficiency in the sector.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 7.0, is rapidly emerging as a key player in the Cargo Ship Maintenance and Overhaul Services Market. The growth is driven by increasing shipping activities, expanding trade routes, and investments in port infrastructure. Countries like China, Japan, and South Korea are witnessing a surge in demand for maintenance services, supported by government initiatives to enhance maritime capabilities.

China stands out as a leader in shipbuilding and maintenance, with companies like Hyundai Heavy Industries Co., Ltd. leading the charge. The competitive landscape is evolving, with local players increasingly adopting advanced technologies to improve service efficiency. As the region continues to grow, the focus on sustainability and compliance with international standards will shape the future of the market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 2.5, presents untapped opportunities in the Cargo Ship Maintenance and Overhaul Services Market. The growth is driven by increasing maritime trade and investments in port infrastructure. Countries like the UAE and South Africa are focusing on enhancing their maritime capabilities, supported by government initiatives aimed at boosting the shipping industry.

The competitive landscape is still developing, with local players beginning to establish their presence in the market. Companies are increasingly looking to collaborate with international firms to leverage expertise and technology. As the region continues to grow, the focus on regulatory compliance and sustainability will be crucial for attracting investment and fostering growth in the maritime sector.