North America : Established Market with Growth Potential

North America is witnessing a steady growth trajectory in the Cargo Handling and Port Services Market, driven by increasing trade volumes and infrastructure investments. The region holds a market share of 40.0, supported by regulatory frameworks that promote efficiency and sustainability in port operations. The demand for advanced cargo handling technologies is also on the rise, as stakeholders seek to enhance operational efficiency and reduce turnaround times.

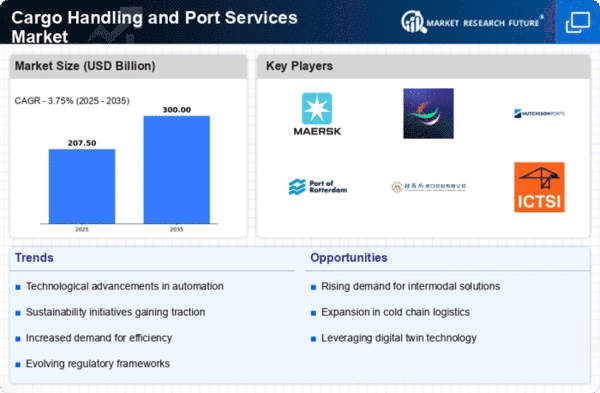

Leading countries such as the United States and Canada dominate the market landscape, with major ports like Los Angeles and New York serving as critical hubs. Key players, including A.P. Moller - Maersk and DP World, are actively investing in innovative solutions to improve service delivery. The competitive landscape is characterized by strategic partnerships and collaborations aimed at optimizing supply chain logistics and enhancing customer satisfaction.

Europe : Innovative Solutions and Sustainability Focus

Europe's Cargo Handling and Port Services Market is characterized by a strong emphasis on innovation and sustainability, holding a market share of 35.0. Regulatory initiatives aimed at reducing carbon emissions and enhancing operational efficiency are driving demand for eco-friendly technologies. The region's strategic location facilitates trade with both Asia and North America, further boosting market growth as stakeholders adapt to evolving logistics demands.

Countries like the Netherlands, Germany, and France are at the forefront, with the Port of Rotterdam being a key player in the global shipping industry. Major companies, including Hutchison Port Holdings and CMA CGM Group, are investing in digital transformation and automation to streamline operations. The competitive landscape is marked by a focus on collaboration among port authorities and private operators to enhance service offerings and meet customer expectations.

Asia-Pacific : Dominant Market with Rapid Expansion

Asia-Pacific is the largest market for Cargo Handling and Port Services, commanding a significant share of 100.0. The region's rapid economic growth, coupled with increasing trade activities, is driving demand for advanced port services. Government initiatives aimed at enhancing port infrastructure and logistics capabilities are further catalyzing market expansion, as countries strive to improve their global trade competitiveness.

China, Japan, and India are leading players in this market, with major ports like Shanghai and Singapore serving as critical nodes in global supply chains. Key players such as China Merchants Port and International Container Terminal Services, Inc. are investing heavily in technology and infrastructure to meet the growing demand. The competitive landscape is dynamic, with a focus on innovation and efficiency to cater to the evolving needs of the shipping industry.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa region is emerging as a significant player in the Cargo Handling and Port Services Market, with a market share of 25.0. The growth is driven by increasing trade activities and investments in port infrastructure, supported by government initiatives aimed at enhancing logistics capabilities. The region's strategic location as a trade corridor between Europe, Asia, and Africa further boosts its market potential.

Countries like the United Arab Emirates and South Africa are leading the charge, with key ports such as Jebel Ali and Durban playing pivotal roles in regional trade. Major players like DP World are focusing on expanding their operations and enhancing service offerings to capture market share. The competitive landscape is evolving, with a growing emphasis on technology adoption and sustainability in port operations.