North America : Market Leader in Supplements

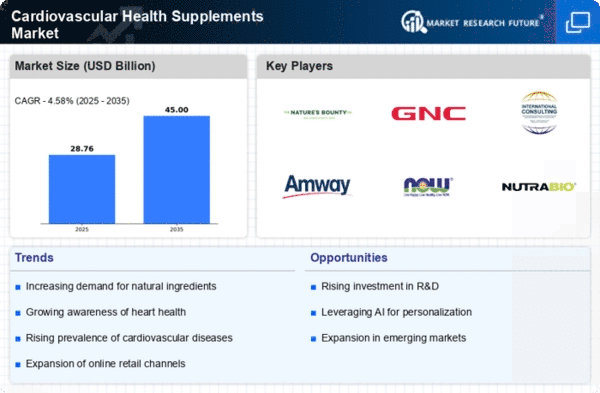

North America continues to lead the Cardiovascular Health Supplements Market, holding a significant share of 12.5 in 2024. The region's growth is driven by increasing health awareness, a rise in cardiovascular diseases, and a growing preference for preventive healthcare. Regulatory support from agencies like the FDA ensures product safety and efficacy, further boosting consumer confidence in supplements. The U.S. is the primary market, with key players such as Nature's Bounty, GNC Holdings, and Herbalife Nutrition dominating the landscape. The competitive environment is characterized by innovation in product formulations and marketing strategies aimed at health-conscious consumers. The presence of established brands and a robust distribution network contribute to the region's market strength.

Europe : Emerging Market with Potential

Europe's Cardiovascular Health Supplements Market is valued at 8.0, reflecting a growing trend towards health and wellness among consumers. Factors such as an aging population, rising healthcare costs, and increased awareness of cardiovascular health are driving demand. Regulatory frameworks, including the European Food Safety Authority (EFSA) guidelines, are enhancing product credibility and safety, encouraging consumer adoption. Leading countries like Germany, France, and the UK are at the forefront of this market, with a mix of local and international brands competing for market share. Companies such as Amway and NOW Foods are expanding their presence through innovative products and strategic partnerships. The competitive landscape is vibrant, with a focus on natural ingredients and scientifically-backed formulations.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 5.5, is witnessing rapid growth in the Cardiovascular Health Supplements Market. Factors such as increasing disposable incomes, urbanization, and a rise in lifestyle-related diseases are propelling demand. Regulatory bodies in countries like Australia and Japan are implementing stringent guidelines to ensure product quality and safety, which is fostering consumer trust in supplements. Countries like China, India, and Japan are leading the market, with a mix of domestic and international players. Companies such as Herbalife Nutrition and NutraBio Labs are capitalizing on the growing health consciousness among consumers. The competitive landscape is evolving, with a focus on innovative formulations and targeted marketing strategies to cater to diverse consumer needs.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region, with a market size of 1.5, is gradually emerging in the Cardiovascular Health Supplements Market. Factors such as increasing health awareness, rising disposable incomes, and a growing prevalence of cardiovascular diseases are driving market growth. Regulatory initiatives aimed at improving food safety and supplement efficacy are also contributing to the market's development. Countries like South Africa and the UAE are leading the way, with a growing number of local and international brands entering the market. The competitive landscape is characterized by a focus on natural and organic products, with companies like Swanson Health Products and Jarrow Formulas expanding their reach. As consumer awareness continues to rise, the market is poised for significant growth in the coming years.