E-commerce Growth

The rapid growth of e-commerce is significantly influencing the Carbon Wheel Market. As online shopping becomes the preferred method for consumers, the accessibility of carbon wheels through digital platforms is expanding. This trend is particularly evident in the rise of specialized online retailers that cater to niche markets, including high-performance cycling and motorsports. The convenience of online purchasing, coupled with detailed product information and customer reviews, enhances consumer confidence in buying carbon wheels. Market data suggests that e-commerce sales in the automotive sector are expected to grow by over 20% in the coming years, further propelling the Carbon Wheel Market. This shift not only broadens the customer base but also allows manufacturers to reach a global audience without the need for extensive physical retail networks.

Customization Trends

Customization trends are emerging as a key driver in the Carbon Wheel Market. Consumers are increasingly looking for personalized products that reflect their individual style and preferences. This trend is particularly evident in the cycling and automotive sectors, where enthusiasts seek unique designs and specifications. Manufacturers are responding by offering customizable options, such as different colors, finishes, and sizes, allowing consumers to tailor their purchases to their specific needs. Market data suggests that the customization segment is projected to grow by approximately 12% over the next few years, as more consumers prioritize individuality in their purchases. This shift not only enhances customer satisfaction but also fosters brand loyalty, as consumers are more likely to return to brands that offer personalized solutions.

Performance Enhancement

The pursuit of performance enhancement is a significant driver in the Carbon Wheel Market. Athletes and automotive enthusiasts alike are increasingly seeking products that offer superior performance characteristics. Carbon wheels are renowned for their lightweight nature, which contributes to improved acceleration and handling. This demand is particularly pronounced in competitive cycling and motorsports, where every gram counts. Market analysis indicates that the performance segment of the carbon wheel market is expected to grow at a rate of 10% annually, as more consumers recognize the benefits of investing in high-quality, performance-oriented products. Manufacturers that focus on performance enhancement are likely to capture a larger share of the market, as they cater to a discerning clientele that prioritizes quality and performance.

Sustainability Initiatives

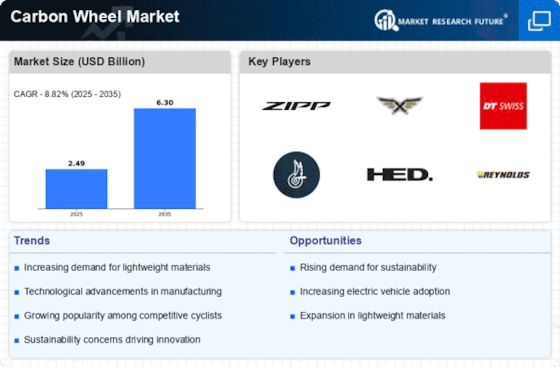

The increasing emphasis on sustainability initiatives is a pivotal driver for the Carbon Wheel Market. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly practices. This shift is reflected in the growing demand for carbon wheels, which are lighter and more durable than traditional materials. The market is projected to witness a compound annual growth rate of approximately 8% over the next five years, driven by the need for sustainable transportation solutions. Furthermore, regulatory frameworks are increasingly favoring low-carbon technologies, incentivizing manufacturers to innovate. The Carbon Wheel Market is thus positioned to benefit from these trends, as companies that prioritize sustainability are likely to gain a competitive edge. This alignment with consumer values not only enhances brand loyalty but also opens new avenues for market expansion.

Technological Advancements

Technological advancements play a crucial role in shaping the Carbon Wheel Market. Innovations in materials science, particularly the development of advanced carbon fiber composites, have significantly enhanced the performance characteristics of carbon wheels. These advancements lead to improved strength-to-weight ratios, which are essential for high-performance vehicles. The integration of smart technologies, such as sensors for monitoring tire pressure and temperature, is also gaining traction. This trend is expected to drive market growth, as consumers increasingly seek products that offer enhanced performance and safety features. The Carbon Wheel Market is likely to see a surge in demand as these technologies become more mainstream, with projections indicating a potential market size increase of over 15% in the next few years. Manufacturers that invest in research and development are poised to capitalize on these technological trends.