Rising Demand in Electronics

The Carbon Graphite Market is experiencing a surge in demand due to the increasing use of carbon graphite in electronic components. As technology advances, the need for lightweight, high-performance materials in devices such as smartphones, laptops, and electric vehicles is becoming more pronounced. The market for electronic components is projected to grow at a compound annual growth rate of approximately 5.5%, which directly influences the carbon graphite sector. This growth is driven by the need for improved conductivity and thermal management in electronic applications, where carbon graphite serves as an ideal material. Consequently, manufacturers are investing in innovative production techniques to enhance the quality and performance of carbon graphite products, thereby expanding their market share in the Carbon Graphite Market.

Growth in Renewable Energy Sector

The Carbon Graphite Market is poised to benefit from the expansion of the renewable energy sector. As the world shifts towards sustainable energy sources, the demand for carbon graphite in applications such as wind turbine blades and solar panels is increasing. Carbon graphite's lightweight and durable properties make it an attractive choice for these applications. The renewable energy market is expected to grow significantly, with investments projected to reach trillions of dollars in the coming years. This growth is likely to create new opportunities for carbon graphite manufacturers, as they adapt their products to meet the specific needs of the renewable energy sector. The integration of carbon graphite into renewable technologies not only enhances performance but also aligns with global sustainability goals, further solidifying its role in the Carbon Graphite Market.

Advancements in Battery Technology

The Carbon Graphite Market is significantly influenced by advancements in battery technology, particularly in the context of electric vehicles and energy storage systems. Carbon graphite is increasingly utilized in anodes for lithium-ion batteries, which are essential for the performance and efficiency of these technologies. The battery market is projected to grow at a compound annual growth rate of around 20%, driven by the rising adoption of electric vehicles and renewable energy storage solutions. This trend indicates a robust demand for high-quality carbon graphite materials that can enhance battery life and performance. As manufacturers innovate and improve the properties of carbon graphite, the industry is likely to see a substantial increase in applications, thereby reinforcing its importance in the Carbon Graphite Market.

Emerging Markets and Economic Development

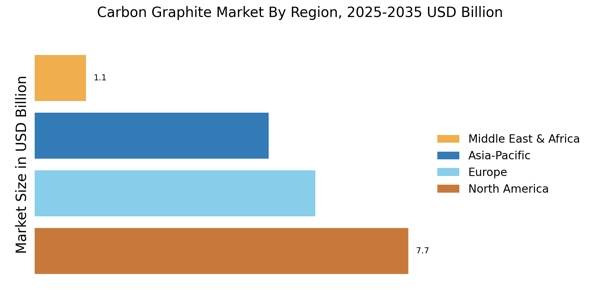

The Carbon Graphite Market is experiencing growth driven by emerging markets and their economic development. Countries with rapidly growing economies are investing in infrastructure and industrialization, leading to an increased demand for carbon graphite in various applications. As these markets develop, the need for advanced materials in construction, automotive, and electronics is becoming more pronounced. The economic growth in these regions is expected to create new opportunities for carbon graphite manufacturers, as they seek to establish a presence in these burgeoning markets. This trend indicates a potential for expansion and diversification within the Carbon Graphite Market, as companies adapt their strategies to meet the unique demands of these emerging economies.

Industrial Applications and Manufacturing

The Carbon Graphite Market is bolstered by its diverse applications across various industrial sectors. Carbon graphite is widely used in manufacturing processes, including lubricants, seals, and gaskets, due to its excellent wear resistance and thermal stability. The industrial sector is expected to witness steady growth, with an increasing focus on efficiency and performance. As industries seek to optimize their operations, the demand for high-quality carbon graphite products is likely to rise. Furthermore, the expansion of manufacturing capabilities in emerging markets presents new opportunities for carbon graphite suppliers. This trend suggests that the Carbon Graphite Market will continue to thrive as industries increasingly recognize the benefits of incorporating carbon graphite into their production processes.