North America : Leading Market Innovators

North America is poised to maintain its leadership in the Carbon Capture and Storage (CCS) market, holding a significant market share of 5.5 in 2024. The region's growth is driven by stringent environmental regulations, increasing investments in clean technologies, and a strong focus on reducing greenhouse gas emissions. Government initiatives and incentives are catalyzing demand for CCS solutions, making it a pivotal area for sustainable energy transition.

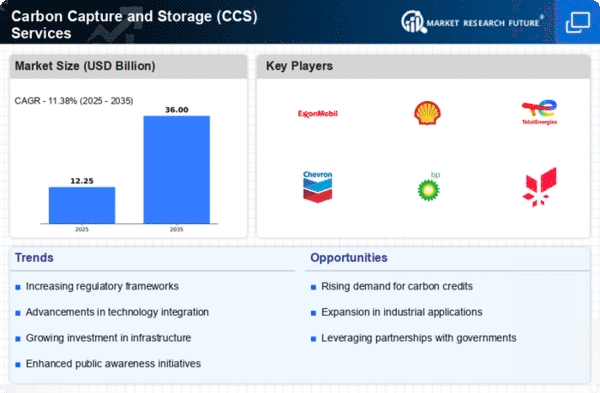

The competitive landscape in North America is robust, featuring key players such as ExxonMobil, Chevron, and Occidental Petroleum. These companies are actively investing in innovative CCS technologies and expanding their operational capacities. The U.S. and Canada are leading the charge, supported by favorable policies and substantial funding for research and development in CCS. This dynamic environment positions North America as a critical hub for CCS advancements.

Europe : Regulatory Frameworks Driving Growth

Europe is rapidly evolving as a significant player in the Carbon Capture and Storage (CCS) sector, with a market size of 3.0. The region benefits from ambitious climate targets and a strong regulatory framework aimed at achieving net-zero emissions by 2050. European governments are implementing policies that incentivize CCS projects, thereby driving demand and investment in this technology. The European Green Deal and various national strategies are pivotal in shaping the CCS landscape.

Leading countries in Europe include the UK, Norway, and the Netherlands, where major companies like Shell and TotalEnergies are spearheading CCS initiatives. The competitive landscape is characterized by collaboration between public and private sectors, fostering innovation and technology transfer. As Europe continues to prioritize sustainability, the CCS market is expected to expand significantly, supported by both regulatory and financial backing.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a gradual increase in Carbon Capture and Storage (CCS) adoption, with a market size of 2.5. This growth is primarily driven by rising energy demands and the urgent need to address climate change. Countries in this region are beginning to recognize the importance of CCS as part of their energy transition strategies, supported by government initiatives and international collaborations aimed at reducing carbon footprints.

Key players in the Asia-Pacific CCS market include companies from Australia, Japan, and China, which are increasingly investing in CCS technologies. The competitive landscape is evolving, with a focus on developing local capabilities and partnerships to enhance CCS implementation. As awareness of climate issues grows, the region is expected to see a significant uptick in CCS projects, aligning with global sustainability goals.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region currently has a negligible market size of 0.0 for Carbon Capture and Storage (CCS) services. However, there is a growing recognition of the potential for CCS to play a vital role in achieving climate goals. The region's abundant fossil fuel resources present unique opportunities for integrating CCS technologies, particularly in oil and gas sectors. Governments are beginning to explore regulatory frameworks to support CCS initiatives, although significant challenges remain.

Countries like South Africa and the UAE are starting to invest in CCS research and pilot projects, aiming to build a foundation for future growth. The competitive landscape is still in its infancy, with few key players actively engaged in CCS development. As the region seeks to diversify its energy sources and reduce emissions, the CCS market is expected to gradually evolve, driven by both local and international investments.