Integration with Digital Health Solutions

The Capsule Endoscopy Market is increasingly integrating with digital health solutions, enhancing the overall patient experience. The incorporation of telemedicine and mobile health applications allows for remote monitoring and consultation, making it easier for patients to access care. This integration not only streamlines the diagnostic process but also facilitates better data management and analysis. As healthcare systems evolve, the demand for such integrated solutions is expected to rise. Market analysts predict that the convergence of capsule endoscopy with digital health technologies could lead to a 15% increase in market penetration by 2027. This trend underscores the importance of adapting to technological advancements in the healthcare sector.

Rising Demand for Non-Invasive Procedures

The Capsule Endoscopy Market is witnessing a surge in demand for non-invasive diagnostic procedures. Patients and healthcare providers alike are increasingly favoring methods that minimize discomfort and risk. Capsule endoscopy offers a unique solution, allowing for comprehensive visualization of the gastrointestinal tract without the need for sedation or invasive techniques. This shift in preference is reflected in market trends, with a notable increase in the number of procedures performed annually. Reports indicate that the number of capsule endoscopies conducted has doubled over the past five years, highlighting a growing acceptance among both patients and physicians. This trend is likely to continue, further propelling the market forward.

Growing Awareness of Gastrointestinal Disorders

The Capsule Endoscopy Market is benefiting from a growing awareness of gastrointestinal disorders among the general population. As more individuals become informed about conditions such as Crohn's disease and gastrointestinal bleeding, the demand for effective diagnostic tools increases. Educational campaigns and improved access to information have led to heightened patient advocacy, prompting individuals to seek out advanced diagnostic options. This awareness is reflected in the rising number of consultations and procedures, with estimates indicating a 20% increase in demand for capsule endoscopy services over the next few years. Consequently, healthcare providers are likely to invest more in these technologies to meet patient needs.

Technological Advancements in Capsule Endoscopy

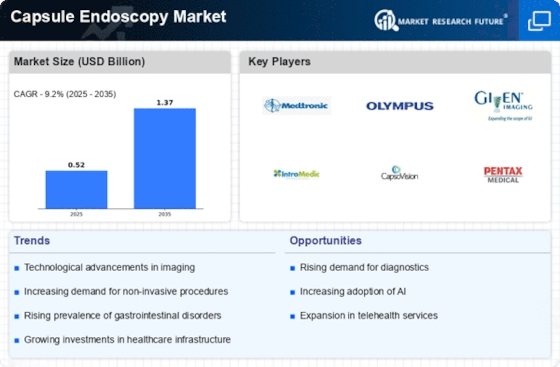

The Capsule Endoscopy Market is experiencing rapid technological advancements that enhance diagnostic capabilities. Innovations such as high-definition imaging, improved battery life, and real-time data transmission are transforming the landscape. These advancements not only improve the accuracy of gastrointestinal examinations but also increase patient comfort. The introduction of wireless technology allows for seamless data transfer, which is crucial for timely diagnosis. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the increasing adoption of advanced capsule endoscopy systems in clinical settings, which are becoming essential tools for gastroenterologists.

Aging Population and Increased Healthcare Expenditure

The Capsule Endoscopy Market is significantly influenced by the aging population and the corresponding increase in healthcare expenditure. As the global demographic shifts towards an older population, the prevalence of gastrointestinal disorders is expected to rise. Older adults are more susceptible to conditions that require thorough examination, thus driving the demand for capsule endoscopy. Furthermore, increased healthcare spending allows for the adoption of advanced medical technologies. Reports suggest that healthcare expenditure is projected to grow by 5% annually, which will likely facilitate greater investment in capsule endoscopy systems. This trend indicates a robust market outlook as healthcare systems adapt to the needs of an aging population.