Market Trends

Key Emerging Trends in the Canned Beverages Market

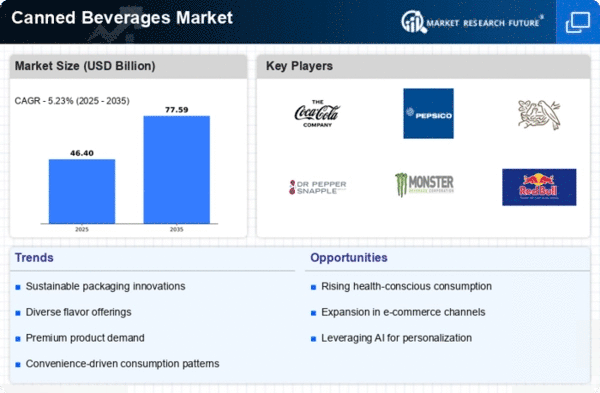

Changing customer preferences, comfort-driven lifestyles, and packing innovation have changed the canned beverage sector. The growing need for quick, convenient refreshments is shaping the industry. Buyers seeking varied and easily accessible incentives turn to canned beverages such carbonated soft drinks, sparkling waters, squeezes, and ready-to-drink teas and espressos. Canned beverages fit modern lifestyles, when busy schedules and the need for portability dictate the choice. This comprehensive study of the global canned beverage industry examines major aspects. The market outline covers Coronavirus effects, market elements, focus on targets, section outline, territorial investigation, serious scene, recent events, division table, and frequently asked questions. In this market, understanding the canned beverage industry's drivers, constraints, challenges, and opportunities is key.

The market gauge is categorized by kind, circulation channel, and district to provide a detailed understanding of each classification's factors. As the canned drinks business grows, it's important to understand industry drivers, execution issues, and emerging opportunities. Partners gain valuable market insights from the division approach's detailed analysis. This study's aggregate data provides a broad picture of the canned beverages market, helping industry members navigate and understand winning market factors. Globalization is crucial to the Canned Beverages business. As global travel and social trade increase, purchasers see a variety of beverages from around the world. This made some canned drinks famous globally, transcending social and territorial boundaries. This style helps makers cater to global clients' tastes with unique flavors and creative touches. Globalisation has also helped industry companies share best practises, circulation, and marketing strategies.

Value matters in the canned beverage sector. Can packaging's cost-effectiveness, robustness, and adaptability make canned drinks more affordable. Producers may provide low prices because to economies of scale and dispersion, making these drinks accessible to a large audience. Value seriousness and financial incentives influence consumer decisions and market factors.

Canned Beverages market factors must consider maintainability. Natural consciousness is making buyers more concerned about single-use bundling's environmental impact. Due to this trend, manufacturers are using eco-friendly, recyclable packaging. Maintainability has become a key market difference, affecting brand loyalty and customer perception.

Mechanical advances in bundling and production help grow the canned beverage sector. Lightweight can materials and can manufacturing advances have improved canned drink packaging's maintainability and efficiency. Drink plan, packaging, and carbonation innovations help maintain the integrity and freshness of the beverages in the jars, fulfilling consumer expectations for flavor and quality.

Leave a Comment