Rising Cyber Threat Landscape

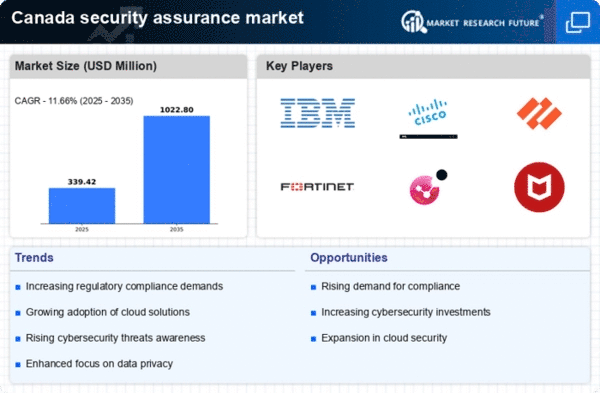

The security assurance market in Canada is experiencing heightened demand due to a complex cyber threat landscape. Organizations are facing sophisticated attacks, including ransomware and phishing, which have surged by approximately 30% in recent years. This escalation compels businesses to invest in robust security assurance measures to protect sensitive data and maintain customer trust. As a result, the market is projected to grow at a CAGR of 12% through 2027. Companies are prioritizing security assurance solutions to mitigate risks and ensure compliance with evolving regulations. The need for comprehensive security frameworks is evident, as organizations strive to safeguard their digital assets against potential breaches. This driver highlights the critical importance of proactive security measures in the face of persistent cyber threats, thereby shaping the future of the security assurance market in Canada.

Evolving Regulatory Environment

The evolving regulatory environment significantly influences the security assurance market in Canada. Government regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), mandate organizations to implement stringent security measures to protect personal data. Non-compliance can result in hefty fines, reaching up to $100,000 for organizations. This regulatory pressure drives businesses to adopt comprehensive security assurance strategies to avoid penalties and enhance their reputational standing. Furthermore, the introduction of new regulations, such as the Digital Charter Implementation Act, emphasizes the need for transparency and accountability in data handling practices. As organizations navigate these regulatory complexities, the demand for security assurance solutions is expected to rise, fostering a more secure digital ecosystem in Canada. This driver underscores the necessity for businesses to align their security practices with regulatory requirements, thereby propelling the growth of the security assurance market.

Increased Awareness of Data Privacy

In Canada, there is a growing awareness of data privacy among consumers and businesses alike, which is significantly impacting the security assurance market. As individuals become more conscious of their personal information and its potential misuse, organizations are compelled to prioritize data protection. Surveys indicate that approximately 70% of Canadians express concerns about their online privacy, prompting businesses to enhance their security assurance measures. This heightened awareness drives companies to invest in advanced security solutions to build consumer trust and ensure compliance with privacy regulations. The market is likely to witness a surge in demand for security assurance services that focus on data protection and privacy management. Consequently, organizations are increasingly adopting security frameworks that not only safeguard data but also demonstrate their commitment to ethical data handling practices. This driver reflects the critical role of consumer awareness in shaping the security assurance market landscape.

Growing Demand for Managed Security Services

There is a growing demand for managed security services (MSS) in the security assurance market in Canada. As organizations face resource constraints and a shortage of skilled cybersecurity professionals, many are turning to MSS providers for comprehensive security solutions. This trend is particularly pronounced among small and medium-sized enterprises (SMEs) that may lack the expertise to implement robust security measures independently. The MSS market is projected to grow at a CAGR of 10% over the next five years, driven by the need for cost-effective and scalable security solutions. By outsourcing security functions to specialized providers, organizations can focus on their core business activities while ensuring their security assurance needs are met. This driver underscores the shift towards managed services as a viable strategy for enhancing security posture, thereby influencing the overall dynamics of the security assurance market in Canada.

Technological Advancements in Security Solutions

Rapid technological advancements in security solutions are propelling the security assurance market in Canada. Innovations such as machine learning, blockchain, and advanced encryption techniques are transforming the way organizations approach security assurance. These technologies enable businesses to detect threats in real-time and respond effectively, thereby reducing the risk of data breaches. The integration of artificial intelligence in security practices is particularly noteworthy, as it enhances the ability to analyze vast amounts of data for potential vulnerabilities. As organizations increasingly adopt these advanced technologies, the market is expected to grow significantly, with estimates suggesting a potential increase of 15% in market size by 2028. This driver highlights the importance of staying abreast of technological developments to maintain a competitive edge in the security assurance market, as organizations seek to leverage innovative solutions to bolster their security posture.