Regulatory Compliance Requirements

Stringent regulatory frameworks in Canada necessitate regular testing and calibration of equipment across various sectors, including healthcare, energy, and environmental monitoring. The renting leasing-test-measurement-equipment market benefits from this need, as organizations often prefer to lease equipment to meet compliance standards without the burden of ownership. For instance, the Canadian Standards Association (CSA) mandates specific testing protocols that require up-to-date equipment. This regulatory landscape encourages businesses to engage with rental services, thereby enhancing the growth potential of the renting leasing-test-measurement-equipment market.

Cost Efficiency and Budget Constraints

In an era where budget constraints are prevalent, many Canadian companies are seeking cost-effective solutions for their testing needs. Renting or leasing test and measurement equipment allows organizations to access high-quality tools without the significant upfront costs associated with purchasing. This approach not only conserves capital but also provides flexibility in upgrading to newer technologies as they become available. The renting leasing-test-measurement-equipment market is likely to see increased activity as businesses prioritize financial prudence while maintaining operational efficiency.

Increased Demand for Precision Testing

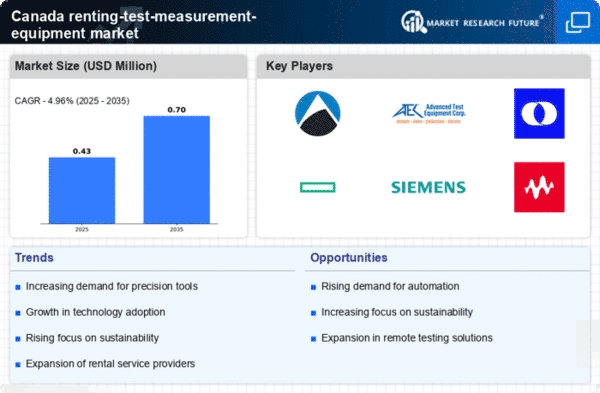

The growing emphasis on precision and accuracy in various industries is driving the demand for the renting leasing-test-measurement-equipment market. Industries such as telecommunications, aerospace, and manufacturing are increasingly reliant on advanced testing equipment to ensure compliance with stringent quality standards. In Canada, the market for test and measurement equipment is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5.2%. This trend indicates that companies are more inclined to rent or lease high-quality equipment rather than invest in costly purchases, thereby boosting the renting leasing-test-measurement-equipment market.

Technological Integration and Innovation

The rapid pace of technological innovation in the test and measurement sector is influencing the renting leasing-test-measurement-equipment market. As new technologies emerge, companies are often hesitant to invest heavily in equipment that may quickly become obsolete. Renting or leasing provides a viable alternative, allowing businesses to utilize the latest advancements without long-term commitments. In Canada, the integration of IoT and AI in testing equipment is particularly noteworthy, as it enhances data collection and analysis capabilities, further driving the demand for rental services in the market.

Growing Focus on Research and Development

The increasing investment in research and development (R&D) across various sectors in Canada is propelling the renting leasing-test-measurement-equipment market. Organizations are recognizing the importance of innovation and are allocating resources to R&D initiatives. This trend necessitates access to specialized testing equipment, which is often more feasible through rental agreements. As R&D budgets expand, the demand for high-quality test and measurement equipment is expected to rise, thereby positively impacting the renting leasing-test-measurement-equipment market.