Growing Demand for Customization

The private cloud-services market in Canada is experiencing a notable increase in demand for tailored solutions. Organizations are seeking to customize their cloud environments to meet specific operational needs, which is driving growth in this sector. According to recent data, approximately 60% of Canadian enterprises express a preference for private cloud solutions that can be adapted to their unique requirements. This trend indicates a shift from standardized offerings to more flexible, bespoke services. As businesses recognize the importance of aligning cloud capabilities with their strategic objectives, the private cloud-services market is likely to expand further. This customization not only enhances operational efficiency but also fosters innovation, as companies can implement solutions that directly address their challenges. Consequently, the private cloud-services market is poised for sustained growth as organizations prioritize personalized cloud experiences.

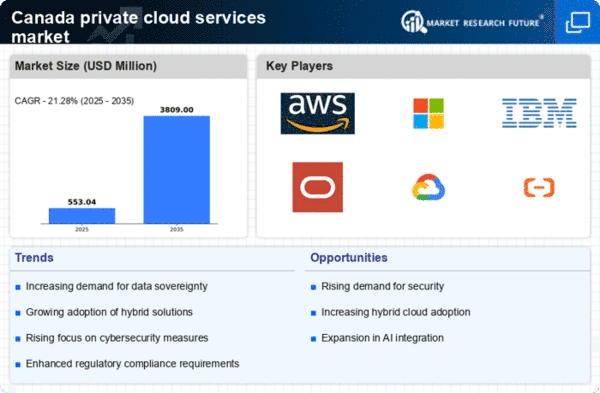

Rising Need for Data Sovereignty

Data sovereignty is becoming increasingly important for Canadian organizations, significantly impacting the private cloud-services market. With stringent data protection regulations in place, businesses are compelled to ensure that their data remains within national borders. This need for compliance with local laws is driving the adoption of private cloud solutions, as they offer greater control over data storage and management. Recent surveys suggest that over 70% of Canadian companies prioritize data sovereignty when selecting cloud services. This trend indicates a growing awareness of the legal implications associated with data handling and storage. As organizations seek to mitigate risks related to data breaches and regulatory penalties, the private cloud services market will see a surge in demand for solutions that guarantee data sovereignty. Consequently, this driver is shaping the landscape of cloud services in Canada.

Shift Towards Hybrid Cloud Models

The private cloud-services market in Canada is witnessing a shift towards hybrid cloud models, which combine private and public cloud environments. This trend is driven by organizations seeking the flexibility to manage workloads across different cloud platforms. Recent data indicates that approximately 55% of Canadian enterprises are adopting hybrid cloud strategies to optimize their IT resources. This approach allows businesses to leverage the benefits of both private and public clouds, enhancing scalability and cost-effectiveness. As companies navigate the complexities of digital transformation, the hybrid model appears to offer a balanced solution that meets diverse operational needs. The private cloud-services market is likely to benefit from this trend, as organizations increasingly recognize the advantages of integrating private cloud solutions with public cloud capabilities. This shift is expected to redefine cloud adoption strategies in Canada.

Increased Investment in IT Infrastructure

Investment in IT infrastructure is a critical driver for the private cloud-services market in Canada. Organizations are allocating substantial budgets to enhance their technological capabilities, with a focus on cloud solutions. Recent statistics indicate that Canadian businesses are expected to increase their IT spending by approximately 8% annually, with a significant portion directed towards private cloud services. This investment is motivated by the need for improved scalability, performance, and security. As companies transition from traditional IT models to cloud-based solutions, the private cloud-services market is likely to benefit from this influx of capital. Enhanced infrastructure not only supports business growth but also enables organizations to leverage advanced technologies such as artificial intelligence and machine learning. Therefore, the ongoing investment in IT infrastructure is a pivotal factor driving the expansion of the private cloud-services market.

Focus on Enhanced Performance and Reliability

Performance and reliability are paramount considerations for organizations in the private cloud-services market in Canada. As businesses increasingly rely on cloud solutions for critical operations, the demand for high-performance services is intensifying. Recent findings suggest that nearly 65% of Canadian companies prioritize performance metrics when selecting cloud providers. This focus on reliability is driving service providers to enhance their offerings, ensuring minimal downtime and optimal performance. Organizations are seeking private cloud solutions that can deliver consistent speed and availability, which is essential for maintaining competitive advantage. As a result, the private cloud-services market is likely to evolve, with providers investing in advanced technologies to meet these performance expectations. This emphasis on enhanced performance and reliability is shaping the future of cloud services in Canada, as businesses strive for operational excellence.