The operational intelligence market in Canada is characterized by a dynamic competitive landscape, driven by the increasing demand for data-driven decision-making and enhanced operational efficiency. Key players such as IBM (CA), Microsoft (CA), and SAP (CA) are at the forefront, each adopting distinct strategies to solidify their market positions. IBM (CA) emphasizes innovation through its AI-driven analytics solutions, while Microsoft (CA) focuses on integrating operational intelligence into its cloud offerings, thereby enhancing accessibility and scalability for businesses. SAP (CA) is strategically positioned through its enterprise resource planning (ERP) systems, which are increasingly incorporating operational intelligence features to streamline business processes. Collectively, these strategies contribute to a competitive environment that is both collaborative and competitive, as companies seek to leverage their technological advancements to capture market share.

In terms of business tactics, companies are increasingly localizing their operations to better serve the Canadian market, optimizing supply chains to enhance efficiency and responsiveness. The market structure appears moderately fragmented, with several key players exerting influence while also facing competition from emerging firms. This fragmentation allows for a diverse range of solutions, catering to various industry needs and preferences, which in turn fosters innovation and adaptability among established players.

In December 2025, IBM (CA) announced a strategic partnership with a leading Canadian telecommunications provider to enhance its operational intelligence capabilities through improved data connectivity. This collaboration is expected to facilitate real-time data analytics, thereby enabling businesses to make more informed decisions swiftly. The strategic importance of this partnership lies in its potential to expand IBM's reach within the telecommunications sector, allowing for the integration of advanced analytics into network operations, which could significantly enhance service delivery.

In November 2025, Microsoft (CA) launched a new suite of operational intelligence tools integrated within its Azure platform, aimed at small to medium-sized enterprises (SMEs). This initiative is particularly noteworthy as it reflects Microsoft's commitment to democratizing access to advanced analytics, enabling SMEs to leverage data insights that were previously accessible only to larger corporations. The strategic significance of this move is profound, as it positions Microsoft as a leader in the operational intelligence space for SMEs, potentially reshaping the competitive dynamics by attracting a new customer base.

In October 2025, SAP (CA) unveiled an upgraded version of its Business Technology Platform, which now includes enhanced operational intelligence features designed to support sustainability initiatives. This development is indicative of a broader trend towards integrating sustainability into operational strategies, as companies increasingly recognize the importance of environmental considerations in their decision-making processes. The strategic relevance of this upgrade lies in its alignment with global sustainability goals, positioning SAP as a forward-thinking leader in operational intelligence that not only drives efficiency but also promotes responsible business practices.

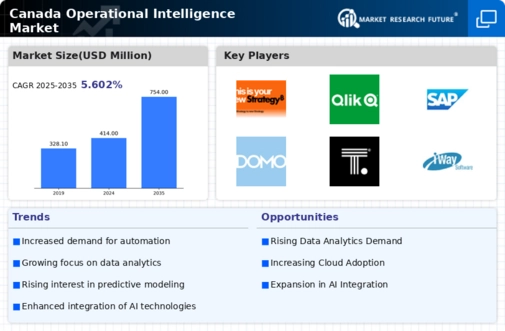

As of January 2026, the operational intelligence market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly pivotal, as companies collaborate to enhance their technological capabilities and market reach. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancement, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex and competitive landscape.