Increased Network Complexity

The growing complexity of network infrastructures in Canada is a primary driver for the network analytics market. As organizations expand their digital footprints, they often deploy a multitude of devices and applications, leading to intricate network environments. This complexity necessitates advanced analytics solutions to monitor performance, troubleshoot issues, and optimize resource allocation. According to recent data, the number of connected devices in Canada is projected to reach 75 million by 2026, which underscores the need for robust analytics tools. The network analytics market is thus positioned to benefit from this trend, as businesses seek to maintain operational efficiency amidst increasing network demands.

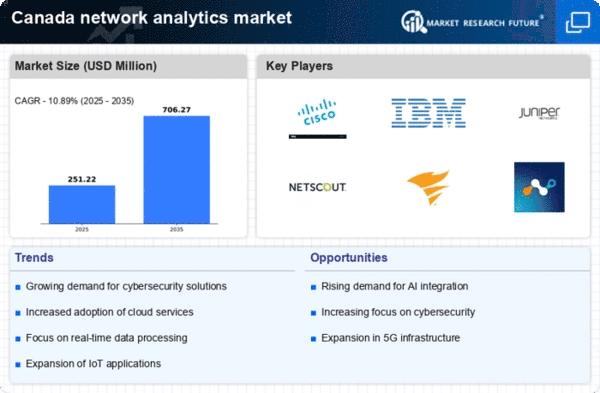

Emergence of IoT Applications

The proliferation of Internet of Things (IoT) devices in Canada is a crucial driver for the network analytics market. With the increasing deployment of IoT applications across various sectors, including healthcare, manufacturing, and smart cities, the need for effective network monitoring and analytics becomes paramount. These devices generate vast amounts of data that require real-time analysis to ensure optimal performance and security. The network analytics market is likely to expand as organizations invest in analytics solutions to manage the complexities associated with IoT networks. It is projected that the number of IoT devices in Canada will exceed 30 million by 2025, highlighting the potential for growth in this sector.

Focus on Operational Efficiency

Organizations in Canada are increasingly prioritizing operational efficiency, which is driving the demand for network analytics solutions. By leveraging analytics tools, businesses can gain insights into network performance, identify bottlenecks, and optimize resource utilization. This focus on efficiency is particularly relevant in competitive industries where cost reduction and productivity enhancement are critical. The network analytics market is expected to benefit from this trend, as companies seek to implement data-driven strategies to improve their operations. Research indicates that organizations that utilize network analytics can achieve up to a 20% reduction in operational costs, further underscoring the value of these solutions.

Growing Adoption of Cloud Services

The shift towards cloud computing in Canada is significantly influencing the network analytics market. As businesses increasingly migrate their operations to the cloud, they require analytics solutions that can provide visibility into cloud-based network performance. This transition is expected to drive demand for network analytics tools that can seamlessly integrate with cloud environments. Recent statistics indicate that the Canadian cloud services market is anticipated to grow at a CAGR of 15% through 2025. Consequently, the network analytics market is poised to capitalize on this growth, as organizations seek to enhance their cloud network management capabilities.

Regulatory Compliance Requirements

In Canada, stringent regulatory frameworks are compelling organizations to adopt network analytics solutions. Compliance with laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA) requires businesses to ensure data security and privacy. Network analytics tools provide the necessary insights to monitor data flows and identify potential breaches, thereby aiding compliance efforts. The network analytics market is likely to see growth as companies invest in these solutions to avoid hefty fines and reputational damage. It is estimated that non-compliance can cost organizations up to $1 million in penalties, further incentivizing the adoption of analytics tools.