Rising Agricultural Efficiency

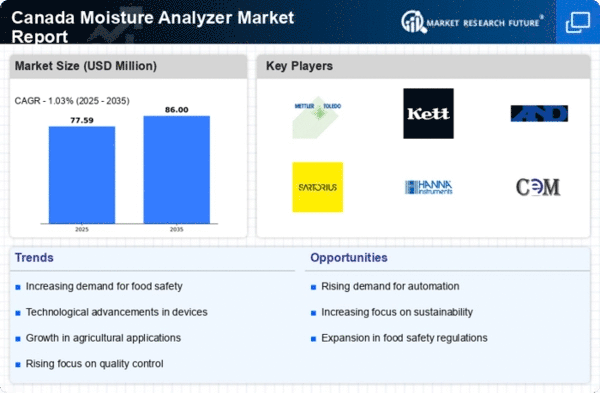

The moisture analyzer market in Canada is experiencing growth due to the increasing need for agricultural efficiency. Farmers are adopting advanced moisture analyzers to optimize irrigation and enhance crop yield. With the agricultural sector contributing approximately 1.6% to Canada's GDP, the demand for precise moisture measurement is critical. These devices help in determining the optimal moisture levels in soil, which can lead to better resource management. As a result, the moisture analyzer market is projected to expand as farmers seek to improve productivity and reduce waste. The integration of moisture analyzers in precision agriculture practices is likely to drive innovation and investment in this sector, further solidifying its importance in the agricultural landscape.

Regulatory Compliance in Food Safety

In Canada, stringent regulations regarding food safety and quality are propelling the moisture analyzer market. The Canadian Food Inspection Agency mandates specific moisture content levels for various food products to ensure safety and quality. As food manufacturers strive to comply with these regulations, the demand for moisture analyzers is expected to rise. The market is likely to see an increase in sales as companies invest in reliable moisture measurement technologies to avoid penalties and ensure product integrity. This regulatory landscape not only drives the adoption of moisture analyzers but also encourages innovation in the development of more accurate and efficient devices, thereby enhancing the overall market growth.

Growing Demand in Construction Sector

The construction sector in Canada is witnessing a surge in demand for moisture analyzers, driven by the need for quality control in building materials. Moisture content in materials such as concrete and wood is critical for ensuring structural integrity and longevity. As the construction industry continues to expand, the moisture analyzer market is likely to benefit from increased investments in quality assurance processes. The emphasis on using moisture analyzers to prevent issues such as mold growth and material degradation is becoming more pronounced. Consequently, construction companies are expected to adopt these devices more widely, contributing to the overall growth of the moisture analyzer market.

Technological Integration in Manufacturing

The moisture analyzer market is benefiting from the integration of advanced technologies in manufacturing processes across various industries in Canada. Industries such as pharmaceuticals, chemicals, and construction are increasingly utilizing moisture analyzers to ensure product quality and consistency. The adoption of automation and smart technologies in manufacturing is likely to enhance the accuracy and efficiency of moisture measurement. As companies seek to improve operational efficiency and reduce costs, the moisture analyzer market is expected to grow. The trend towards Industry 4.0, characterized by interconnected devices and data analytics, may further drive the demand for sophisticated moisture analyzers, positioning them as essential tools in modern manufacturing.

Increased Focus on Environmental Sustainability

The moisture analyzer market is also influenced by the growing emphasis on environmental sustainability in Canada. Industries are increasingly recognizing the importance of moisture management in reducing waste and conserving resources. By utilizing moisture analyzers, companies can optimize their processes, leading to lower energy consumption and reduced environmental impact. This trend aligns with Canada's commitment to sustainability and climate change initiatives. As organizations strive to meet sustainability goals, the demand for moisture analyzers is likely to rise, positioning them as vital tools in promoting eco-friendly practices. The moisture analyzer market may see a shift towards more sustainable technologies, further enhancing its relevance in various sectors.