Increased Mobile Device Penetration

The proliferation of mobile devices in Canada is a key driver for the mobile biometric-security-service market. With over 80% of Canadians owning smartphones, the integration of biometric security features into these devices is becoming increasingly common. This widespread adoption of mobile technology creates a fertile ground for biometric solutions, as users seek convenient and secure methods for authentication. The mobile biometric-security-service market is likely to benefit from this trend, as more consumers and businesses recognize the advantages of biometric authentication over traditional methods. Furthermore, the rise of mobile banking and e-commerce is further propelling the demand for secure mobile transactions. As a result, the market is expected to witness substantial growth, with estimates suggesting an increase in market share by approximately 20% in the coming years.

Rising Demand for Enhanced Security Solutions

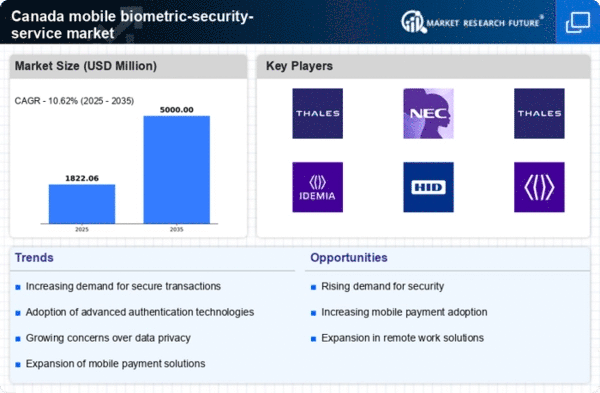

The mobile biometric-security-service market in Canada is experiencing a notable surge in demand for enhanced security solutions. As cyber threats and identity theft incidents escalate, organizations are increasingly seeking advanced biometric technologies to safeguard sensitive data. This trend is particularly pronounced in sectors such as finance and healthcare, where the need for robust security measures is paramount. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the necessity for secure authentication methods. The integration of biometric solutions, such as fingerprint and facial recognition, into mobile devices is becoming a standard practice, thereby propelling the mobile biometric-security-service market forward. This growing emphasis on security is likely to shape the future landscape of mobile biometric technologies in Canada.

Growing Awareness of Privacy and Data Security

In Canada, there is a growing awareness among consumers and businesses regarding privacy and data security, which is significantly impacting the mobile biometric-security-service market. As data breaches and privacy concerns become more prevalent, individuals are increasingly prioritizing secure authentication methods. This heightened awareness is prompting organizations to adopt biometric solutions to protect sensitive information and comply with data protection regulations. The mobile biometric-security-service market is likely to see a surge in demand as companies strive to enhance their security measures and build consumer trust. Additionally, public awareness campaigns and educational initiatives are contributing to this trend, further emphasizing the importance of biometric security. As a result, the market is expected to grow steadily, with projections indicating a potential increase in adoption rates by 25% over the next few years.

Technological Advancements in Biometric Systems

Technological advancements are playing a crucial role in the evolution of the mobile biometric-security-service market in Canada. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems, making them more appealing to businesses and consumers alike. For instance, the introduction of multi-modal biometric systems, which combine various biometric traits, is gaining traction. This not only improves security but also enhances user experience. The Canadian market is witnessing an influx of investments in research and development, with companies allocating substantial budgets to innovate and refine biometric technologies. As a result, the mobile biometric-security-service market is expected to expand significantly, with projections indicating a potential market value exceeding $1 billion by 2027. This trend underscores the importance of continuous technological evolution in meeting the growing security demands.

Supportive Government Initiatives and Regulations

Supportive government initiatives and regulations are emerging as a significant driver for the mobile biometric-security-service market in Canada. The Canadian government is actively promoting the adoption of biometric technologies to enhance national security and streamline identification processes. Various initiatives aimed at fostering innovation in biometric solutions are being implemented, which could potentially lead to increased funding and support for research and development. Furthermore, regulatory frameworks are being established to ensure the ethical use of biometric data, thereby instilling confidence among consumers and businesses. This supportive environment is likely to encourage investment in the mobile biometric-security-service market, with expectations of a market growth rate of around 18% in the coming years. As regulations evolve, the market is poised to benefit from increased legitimacy and consumer acceptance of biometric technologies.