Regulatory Compliance Pressures

Regulatory compliance pressures are increasingly influencing the managed detection-response market in Canada. Organizations are required to adhere to stringent data protection regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA). Non-compliance can result in hefty fines and reputational damage, prompting businesses to seek managed detection-response services to ensure compliance. The managed detection-response market industry is likely to see growth as companies prioritize solutions that not only enhance security but also facilitate adherence to regulatory requirements. This trend indicates a shift towards integrated security frameworks that align with compliance mandates, further driving demand for specialized services.

Increased Investment in IT Security

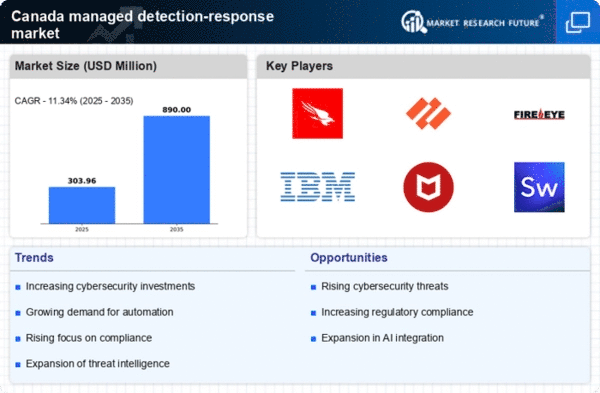

Investment in IT security is a key driver for the managed detection-response market in Canada. Organizations are allocating larger portions of their budgets to cybersecurity, with a projected increase of 15% in IT security spending in 2025. This trend reflects a growing recognition of the importance of protecting sensitive data and maintaining operational integrity. The managed detection-response market industry stands to gain from this influx of capital, as businesses seek comprehensive solutions that offer real-time monitoring and incident response. As the threat landscape evolves, the demand for specialized services within the managed detection-response market is likely to expand, further solidifying its role in the broader cybersecurity framework.

Growing Cybersecurity Threat Landscape

The managed detection-response market is experiencing growth due to the escalating cybersecurity threats faced by organizations in Canada. With a reported increase in cyber incidents, businesses are compelled to adopt advanced security measures. In 2025, it is estimated that cybercrime will cost Canadian businesses over $10 billion annually. This alarming trend drives the demand for managed detection-response services, as companies seek to enhance their security posture and mitigate risks. The managed detection-response market industry is thus positioned to benefit from this heightened awareness and urgency surrounding cybersecurity, as organizations prioritize investments in robust detection and response capabilities.

Shift Towards Remote Work Environments

The shift towards remote work environments has significantly impacted the managed detection-response market. As more organizations adopt flexible work arrangements, the attack surface for cyber threats has broadened. This transition necessitates enhanced security measures, prompting businesses to invest in managed detection-response services. In 2025, it is anticipated that remote work will account for over 30% of the Canadian workforce, underscoring the need for effective cybersecurity solutions. The managed detection-response market industry is thus positioned to address the unique challenges posed by remote work, offering tailored services that ensure secure access to corporate resources and data.

Emergence of Advanced Threat Detection Technologies

The emergence of advanced threat detection technologies is reshaping the managed detection-response market landscape. Innovations such as machine learning and behavioral analytics are enhancing the ability to identify and respond to threats in real-time. As organizations in Canada increasingly adopt these technologies, the demand for managed detection-response services is expected to rise. In 2025, it is projected that the market for threat detection solutions will grow by 20%, reflecting the critical role these technologies play in the managed detection-response market industry. This evolution suggests a future where organizations leverage cutting-edge tools to bolster their cybersecurity defenses, driving further investment in managed detection-response capabilities.