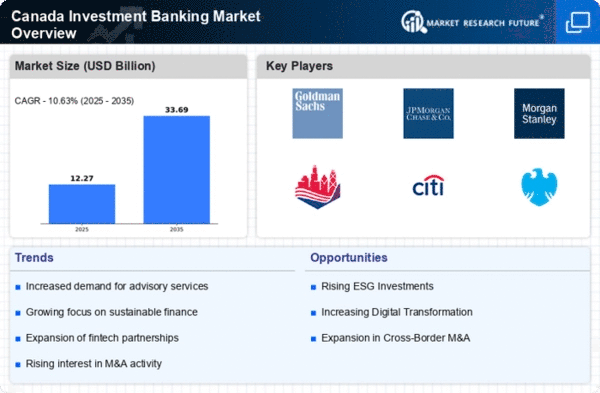

Mergers and Acquisitions Activity

The Investment Banking Sector in Canada is experiencing a notable uptick in mergers and acquisitions (M&A) activity. In recent years, the total value of M&A transactions has surged, reflecting a growing appetite among companies for consolidation and strategic partnerships. In 2025, the total M&A value reached approximately $150 billion, indicating a robust environment for investment banks to facilitate these transactions. This trend is driven by various factors, including low interest rates and a favorable economic climate, which encourage companies to pursue growth through acquisitions. Investment banks play a crucial role in advising clients on M&A deals, structuring transactions, and securing financing, thereby positioning themselves as key players in this dynamic market. The increasing complexity of these transactions may also lead to heightened demand for specialized advisory services within the investment banking market.

Regulatory Changes and Compliance

The Investment Banking Sector in Canada is currently influenced by evolving regulatory frameworks. Recent adjustments in compliance requirements necessitate that investment banks adapt their operations to meet new standards. For instance, the implementation of the Basel III framework has led to increased capital requirements, compelling banks to reassess their risk management strategies. This regulatory landscape may drive investment banks to enhance their compliance departments, thereby increasing operational costs. Furthermore, the Canadian Securities Administrators have introduced measures aimed at improving transparency and investor protection, which could further impact the investment banking market. As a result, firms that proactively adapt to these changes may gain a competitive edge, while those that lag behind could face significant challenges in maintaining their market position.

Investor Sentiment and Market Confidence

Investor sentiment plays a pivotal role in shaping the Investment Banking Sector in Canada. As market confidence fluctuates, so too does the demand for investment banking services. In 2025, a survey indicated that 70% of institutional investors expressed optimism about the Canadian economy, which could lead to increased capital flows and investment activity. This positive sentiment may drive higher demand for equity and debt issuance, as companies seek to capitalize on favorable market conditions. Conversely, any downturn in investor confidence could result in a slowdown in capital markets activity, impacting the revenue streams of investment banks. Therefore, understanding and responding to shifts in investor sentiment is crucial for firms operating within the investment banking market.

Global Economic Trends and Trade Relations

The Investment Banking Sector in Canada is significantly influenced by global economic trends and trade relations. As Canada is a trading nation, fluctuations in international markets can have direct implications for investment banking activities. For instance, changes in trade agreements or tariffs can affect cross-border transactions and foreign direct investment. In 2025, the ongoing negotiations surrounding trade agreements with key partners may create both opportunities and challenges for investment banks. A favorable trade environment could enhance deal flow and increase the demand for advisory services, while trade tensions may lead to uncertainty and reduced activity. Consequently, investment banks must remain vigilant and adaptable to the evolving The investment banking market.

Technological Advancements in Financial Services

Technological advancements are reshaping the Investment Banking Sector in Canada, as firms increasingly leverage digital tools to enhance efficiency and client service. The rise of fintech companies has introduced innovative solutions that streamline processes such as trading, risk assessment, and client onboarding. Investment banks are investing in technology to remain competitive, with expenditures on digital transformation projected to reach $2 billion in 2025. This shift towards automation and data analytics not only improves operational efficiency but also enables banks to offer more personalized services to clients. As the investment banking market continues to evolve, firms that successfully integrate technology into their operations may gain a significant advantage over their competitors, potentially leading to increased market share and profitability.