Rising Demand for Automation

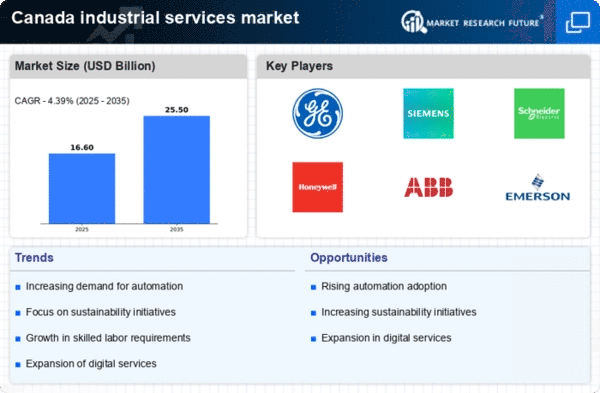

The industrial services market in Canada is experiencing a notable shift towards automation, driven by the need for increased efficiency and productivity. As industries seek to optimize operations, the integration of automated systems is becoming essential. In 2025, it is estimated that approximately 30% of manufacturing processes will be automated, reflecting a significant increase from previous years. This trend is likely to enhance operational efficiency, reduce labor costs, and minimize human error. Consequently, service providers in the industrial services market must adapt to this evolving landscape by offering specialized automation solutions. The demand for skilled technicians and engineers to implement and maintain these systems is also expected to rise, further shaping the workforce dynamics within the industrial services market.

Focus on Safety and Compliance

Safety and compliance regulations are becoming increasingly stringent within the industrial services market in Canada. Companies are required to adhere to various safety standards to protect workers and the environment. In 2025, it is anticipated that compliance-related expenditures will account for approximately 15% of operational budgets in the industrial sector. This focus on safety is driving demand for specialized services that ensure adherence to regulations, including training, audits, and risk assessments. Service providers that can offer comprehensive safety solutions will likely find a competitive advantage in the market. Furthermore, as industries strive to enhance their safety records, the industrial services market must evolve to provide innovative solutions that address these compliance challenges.

Emergence of Smart Manufacturing

The concept of smart manufacturing is gaining traction within the industrial services market in Canada. This approach leverages advanced technologies such as IoT, AI, and big data analytics to create interconnected manufacturing systems. By 2025, it is projected that smart manufacturing will account for over 25% of total manufacturing output in Canada. This shift is likely to drive demand for industrial services that support the implementation and maintenance of smart technologies. Companies will require expertise in data management, system integration, and cybersecurity to navigate this complex landscape. As a result, service providers must enhance their capabilities to meet the needs of clients transitioning to smart manufacturing, positioning themselves as essential partners in this evolution.

Sustainability and Green Practices

Sustainability is becoming a pivotal concern within the industrial services market in Canada. Companies are increasingly adopting green practices to reduce their environmental footprint and comply with regulatory requirements. In 2025, it is estimated that investments in sustainable technologies and practices will reach $50 billion, significantly impacting the industrial services market. This trend is likely to create opportunities for service providers that specialize in energy efficiency, waste management, and sustainable sourcing. As industries strive to meet sustainability goals, the demand for innovative solutions that promote environmental stewardship will grow. Consequently, the industrial services market must adapt to these changing expectations, offering services that align with the sustainability objectives of their clients.

Investment in Infrastructure Development

Infrastructure development remains a critical driver for the industrial services market in Canada. The government has committed substantial funding towards enhancing transportation, energy, and communication infrastructures. In 2025, public and private investments in infrastructure are projected to exceed $100 billion, creating a robust demand for industrial services. This influx of capital is likely to stimulate growth in sectors such as construction, logistics, and energy, all of which rely heavily on industrial services. As infrastructure projects progress, the need for maintenance and support services will also increase, providing opportunities for service providers to expand their offerings. The industrial services market must be prepared to meet the evolving needs of these infrastructure projects to capitalize on this growth.