Regulatory Support for Innovation

The regulatory landscape in Canada is evolving to support innovation within the generative ai fintech market. The Canadian government has introduced various initiatives aimed at fostering technological advancements while ensuring consumer protection. For instance, the Office of the Superintendent of Financial Institutions (OSFI) has been actively engaging with fintech firms to understand their needs and challenges. This collaborative approach may lead to the development of more favorable regulations that encourage the adoption of generative AI technologies. As a result, fintech companies that align their operations with regulatory expectations are likely to thrive in the Canada generative ai fintech market, potentially leading to increased investment and growth opportunities.

Integration of AI in Risk Management

The integration of generative AI in risk management is becoming a pivotal driver in the Canada generative ai fintech market. Financial institutions are increasingly adopting AI-driven tools to enhance their risk assessment and management processes. These technologies enable firms to analyze complex datasets and identify potential risks more effectively. As a result, companies can make informed decisions that mitigate financial losses and improve overall stability. The growing emphasis on risk management, particularly in light of recent market fluctuations, suggests that generative AI will play a crucial role in shaping the future of the Canada generative ai fintech market.

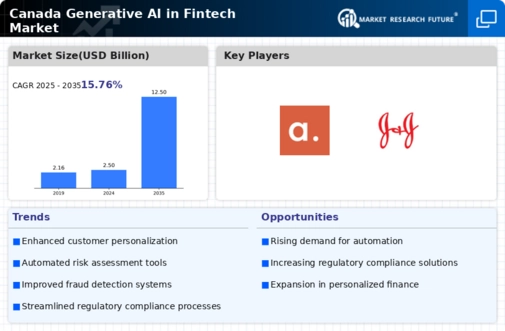

Rising Investment in AI Technologies

Investment in AI technologies is on the rise within the Canada generative ai fintech market. Venture capital funding for fintech startups has seen a notable increase, with reports indicating that Canadian fintech companies raised over CAD 1 billion in 2025 alone. This influx of capital is primarily directed towards developing generative AI solutions that enhance financial services. Investors are increasingly recognizing the potential of AI-driven innovations to transform traditional financial models. Consequently, this trend may lead to the emergence of new players in the Canada generative ai fintech market, fostering a competitive environment that drives further advancements in technology and service delivery.

Consumer Trust in AI-Driven Solutions

Consumer trust in AI-driven financial solutions is a critical factor influencing the Canada generative ai fintech market. As consumers become more familiar with AI technologies, their willingness to engage with AI-driven financial services is increasing. Surveys indicate that approximately 70 percent of Canadians are open to using AI for financial advice, provided that transparency and security measures are in place. This growing trust may encourage more fintech companies to adopt generative AI solutions, ultimately enhancing service offerings and customer experiences. The ability to build and maintain consumer trust will likely be a determining factor for success in the Canada generative ai fintech market.

Increased Demand for Personalized Financial Solutions

The Canada generative ai fintech market is witnessing a surge in demand for personalized financial solutions. Consumers increasingly seek tailored services that cater to their unique financial situations. This trend is driven by advancements in generative AI technologies, which enable fintech companies to analyze vast amounts of data and deliver customized recommendations. According to recent statistics, over 60 percent of Canadian consumers express a preference for personalized financial advice. This growing expectation compels fintech firms to innovate and leverage generative AI to enhance customer engagement and satisfaction. As a result, companies that successfully implement these technologies are likely to gain a competitive edge in the Canada generative ai fintech market.