Expansion of AI Talent Pool

The enterprise artificial-intelligence market is experiencing a notable expansion of the talent pool in Canada, driven by educational institutions and training programs focusing on AI skills. Universities and colleges are increasingly offering specialized courses in AI and machine learning, which is essential for meeting the growing demand for skilled professionals in this field. Recent statistics suggest that the number of graduates in AI-related disciplines has increased by 50% over the past three years. This influx of talent is crucial for supporting the development and implementation of AI solutions across various industries. As organizations seek to harness the potential of AI, the availability of a skilled workforce is likely to play a pivotal role in the growth of the enterprise artificial-intelligence market.

Rising Demand for Automation Solutions

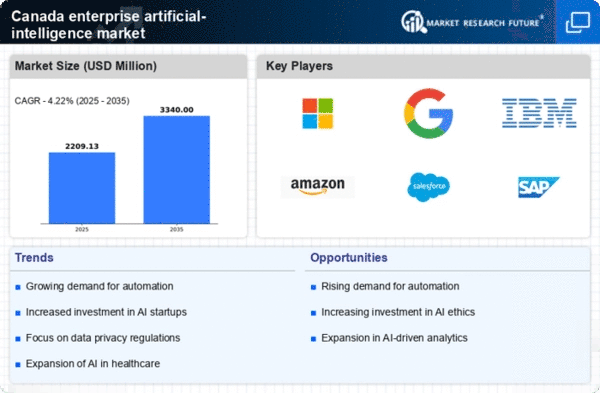

The enterprise artificial-intelligence market in Canada experiences a notable surge in demand for automation solutions across various sectors. Organizations are increasingly adopting AI technologies to streamline operations, enhance productivity, and reduce operational costs. According to recent data, the automation market is projected to grow at a CAGR of 25% over the next five years. This trend indicates a strong inclination towards integrating AI-driven automation tools, which can significantly improve efficiency and accuracy in tasks ranging from customer service to supply chain management. As businesses recognize the potential of AI to transform their operations, the enterprise artificial-intelligence market is likely to expand, driven by the need for innovative solutions that can adapt to evolving market demands.

Advancements in Natural Language Processing

Natural Language Processing (NLP) is witnessing significant advancements, which are positively impacting the enterprise artificial-intelligence market in Canada. The ability of AI systems to understand and generate human language is transforming customer interactions and support services. Recent studies indicate that companies implementing NLP solutions have seen a 40% increase in customer satisfaction rates. This technology enables businesses to automate responses, analyze customer feedback, and personalize communication, thereby enhancing overall customer experience. As NLP continues to evolve, its integration into various enterprise applications is likely to drive further growth in the enterprise artificial-intelligence market, as organizations seek to improve engagement and streamline communication.

Growing Focus on Data-Driven Decision Making

In the enterprise artificial-intelligence market, there is an increasing emphasis on data-driven decision-making processes. Canadian companies are leveraging AI technologies to analyze vast amounts of data, enabling them to derive actionable insights and make informed strategic choices. This shift towards data-centric approaches is supported by the fact that organizations utilizing AI for analytics report a 30% improvement in decision-making speed. As businesses strive to remain competitive, the integration of AI into their decision-making frameworks is becoming essential. This trend not only enhances operational efficiency but also positions companies to respond more effectively to market changes, thereby driving growth in the enterprise artificial-intelligence market.

Increased Regulatory Support for AI Development

The enterprise artificial-intelligence market in Canada benefits from increased regulatory support aimed at fostering AI development and innovation. Government initiatives are being introduced to create a conducive environment for AI research and implementation. For instance, funding programs and tax incentives are being offered to encourage businesses to invest in AI technologies. This regulatory landscape not only promotes growth but also ensures that AI applications adhere to ethical standards and best practices. As a result, the enterprise artificial-intelligence market is likely to see a boost in investment and innovation, as companies leverage these supportive measures to enhance their AI capabilities.