Investment from Private Sector

The influx of investment from the private sector is a significant driver of the Canada Electric Vehicle Ev Charging Infrastructure Market. Major automotive manufacturers and technology companies are increasingly investing in charging infrastructure to support their EV offerings. For instance, several automakers have announced plans to build extensive networks of charging stations across Canada, aiming to enhance the accessibility of charging options for consumers. This private sector involvement not only accelerates the deployment of charging stations but also fosters competition, leading to improved services and technologies. As investment continues to grow, it is likely to create a more robust and comprehensive charging network, further facilitating the transition to electric vehicles.

Public Awareness and Education

Public awareness and education regarding electric vehicles and charging infrastructure are vital drivers of the Canada Electric Vehicle Ev Charging Infrastructure Market. As consumers become more informed about the benefits of EVs, including lower emissions and reduced fuel costs, the interest in electric vehicles is likely to rise. Educational campaigns by government bodies and non-profit organizations aim to dispel myths surrounding EVs and promote the advantages of adopting electric transportation. Additionally, as more Canadians become aware of the available charging options and their locations, the perceived barriers to EV ownership diminish. This increased awareness is expected to drive demand for charging infrastructure, ultimately supporting the growth of the market.

Government Policies and Regulations

Government policies and regulations play a crucial role in shaping the Canada Electric Vehicle Ev Charging Infrastructure Market. The Canadian government has set ambitious targets to reduce greenhouse gas emissions, aiming for a 40-45% reduction by 2030 compared to 2005 levels. To achieve these goals, various incentives and funding programs have been introduced to promote EV adoption and the development of charging infrastructure. For instance, the Zero-Emission Vehicle Infrastructure Program allocates funds to support the installation of charging stations across the country. These initiatives not only encourage consumers to switch to EVs but also stimulate investment in charging infrastructure, thereby enhancing the overall market landscape.

Growing Demand for Electric Vehicles

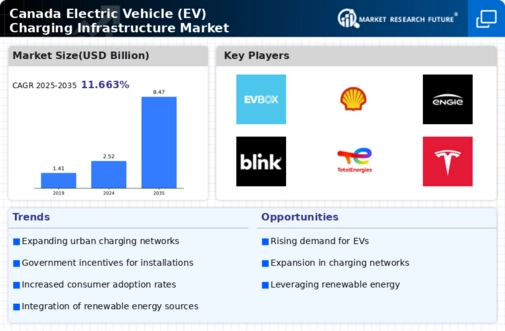

The increasing consumer demand for electric vehicles (EVs) in Canada is a primary driver for the Canada Electric Vehicle EV Charging Infrastructure Market. As of 2025, EV sales accounted for approximately 10% of total vehicle sales in Canada, reflecting a significant shift towards sustainable transportation. This trend is expected to continue, with projections indicating that by 2030, EVs could represent up to 30% of new vehicle sales. The rising awareness of environmental issues and the desire for lower operating costs are propelling consumers towards EV adoption. Consequently, the demand for a robust charging infrastructure is paramount to support this growth, as consumers seek convenient and accessible charging options to alleviate range anxiety.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are significantly influencing the Canada Electric Vehicle Ev Charging Infrastructure Market. Innovations such as fast-charging stations and wireless charging technologies are enhancing the convenience and efficiency of EV charging. As of early 2026, the deployment of Level 3 DC fast chargers has increased, allowing EVs to charge up to 80% in approximately 30 minutes. This rapid charging capability is essential for long-distance travel and is likely to attract more consumers to electric vehicles. Furthermore, the integration of smart charging technologies, which optimize energy use and reduce costs, is expected to further bolster the infrastructure market, making it more appealing to both consumers and investors.