Expansion of 5G Infrastructure

The ongoing expansion of 5G infrastructure in Canada significantly influences the edge ai-hardware market. With 5G technology offering enhanced connectivity and reduced latency, it enables more efficient data transmission between devices and edge servers. This technological advancement is crucial for applications that require high-speed data processing, such as autonomous vehicles and smart cities. The Canadian government has been actively promoting the rollout of 5G networks, which is expected to reach 90% of urban areas by 2026. This widespread adoption of 5G is likely to create new opportunities for edge ai-hardware, as businesses seek to leverage the benefits of faster and more reliable connectivity. As a result, the edge ai-hardware market is poised for substantial growth, driven by the increasing demand for advanced applications that rely on 5G capabilities.

Growing Focus on Data Privacy and Security

In an era where data breaches and cyber threats are increasingly prevalent, the edge ai-hardware market in Canada is witnessing a growing focus on data privacy and security. Organizations are becoming more aware of the vulnerabilities associated with centralized data storage and processing. As a result, there is a shift towards edge computing solutions that allow for localized data processing, thereby minimizing exposure to potential threats. This trend is particularly relevant in sectors such as finance and healthcare, where sensitive information is handled. The Canadian government has also introduced regulations aimed at enhancing data protection, which further drives the demand for secure edge ai-hardware solutions. Consequently, companies are investing in advanced security features within their edge devices, contributing to the overall growth of the market.

Integration of AI in Industrial Automation

The integration of artificial intelligence in industrial automation is a key driver for the edge ai-hardware market in Canada. As manufacturers seek to optimize production processes and reduce operational costs, the adoption of AI-driven solutions becomes essential. Edge ai-hardware plays a critical role in enabling real-time analytics and machine learning applications at the production site, allowing for predictive maintenance and quality control. Recent studies indicate that the industrial sector in Canada is expected to invest over $1 billion in AI technologies by 2027, further underscoring the importance of edge computing in this context. This trend not only enhances productivity but also fosters innovation within the manufacturing landscape, thereby propelling the edge ai-hardware market forward as companies strive to remain competitive.

Rising Demand for Real-Time Data Processing

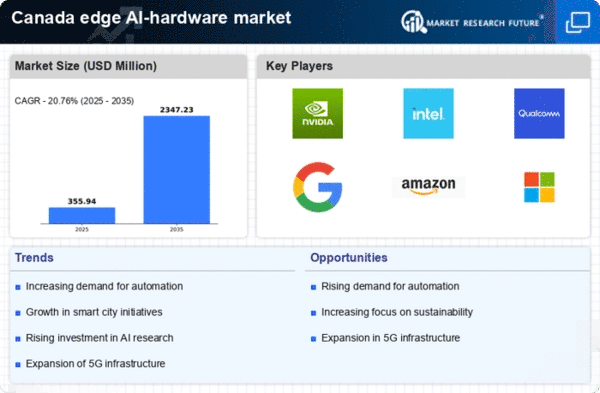

The edge ai-hardware market in Canada experiences a notable surge in demand for real-time data processing capabilities. As industries increasingly rely on instantaneous data analysis for decision-making, the need for edge computing solutions becomes paramount. This trend is particularly evident in sectors such as manufacturing and healthcare, where timely insights can lead to improved operational efficiency and patient outcomes. According to recent estimates, the market for edge ai-hardware is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the necessity for low-latency processing and the ability to handle large volumes of data generated by IoT devices. Consequently, companies are investing heavily in edge ai-hardware to enhance their data processing capabilities, thereby propelling the overall market forward.

Increased Investment in Smart City Initiatives

The edge ai-hardware market in Canada is significantly influenced by increased investment in smart city initiatives. As urban areas strive to enhance infrastructure and improve the quality of life for residents, the integration of smart technologies becomes essential. Edge ai-hardware facilitates the deployment of various applications, including traffic management, waste management, and public safety systems. Canadian municipalities are allocating substantial budgets towards these initiatives, with projections indicating that smart city investments could exceed $2 billion by 2027. This influx of funding is likely to drive demand for edge ai-hardware, as cities require robust solutions to process data generated by numerous sensors and devices. As a result, the edge ai-hardware market is expected to expand, fueled by the growing emphasis on urban innovation and sustainability.