Rising Cybersecurity Concerns

Cybersecurity threats are a significant driver influencing the digital identity-in-government-sector market. With the increasing frequency of data breaches and cyberattacks, government agencies are compelled to prioritize the security of digital identity systems. In Canada, the government has allocated substantial resources to bolster cybersecurity measures, recognizing that a secure digital identity framework is essential for protecting sensitive citizen information. The market is expected to expand as agencies seek advanced solutions to mitigate risks associated with identity theft and fraud. This heightened focus on cybersecurity not only enhances the integrity of digital identity systems but also encourages public trust in government services, thereby driving further adoption of digital identity solutions.

Growing Demand for Secure Digital Services

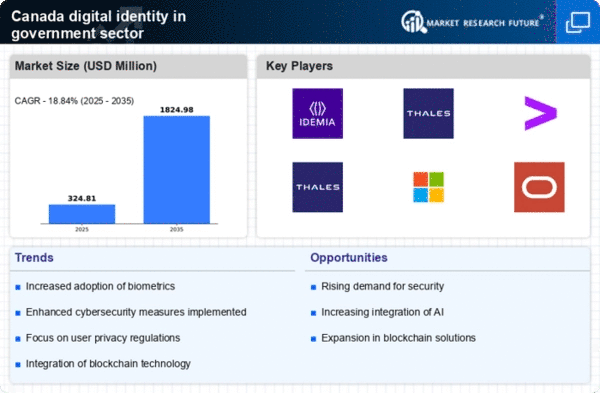

The digital identity-in-government-sector market is experiencing a notable surge in demand for secure digital services. As citizens increasingly seek efficient and reliable online interactions with government entities, the necessity for robust digital identity solutions becomes paramount. In Canada, the government has recognized this trend, leading to investments in advanced identity verification technologies. Reports indicate that the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for secure access to services such as tax filing, healthcare, and social benefits, which require stringent identity verification processes. Consequently, the digital identity-in-government-sector market is evolving to meet these demands, ensuring that citizens can engage with government services safely and conveniently.

Regulatory Support for Digital Identity Initiatives

Regulatory frameworks play a crucial role in shaping the digital identity-in-government-sector market. In Canada, the government has implemented various policies aimed at promoting the adoption of digital identity solutions. Initiatives such as the Digital Identity and Authentication Council of Canada (DIACC) are designed to establish standards and guidelines for secure digital identity management. This regulatory support not only fosters innovation but also instills public confidence in digital services. As a result, the market is likely to witness increased participation from both public and private sectors, enhancing the overall ecosystem. The alignment of regulatory measures with technological advancements suggests a promising future for the digital identity-in-government-sector market, potentially leading to a more integrated and secure digital landscape.

Technological Advancements in Identity Verification

Technological advancements are significantly shaping the digital identity-in-government-sector market. Innovations such as artificial intelligence (AI) and machine learning are being integrated into identity verification processes, enhancing accuracy and efficiency. In Canada, government agencies are increasingly adopting these technologies to streamline service delivery and improve user experience. The market is projected to benefit from these advancements, as they enable faster processing times and reduce the likelihood of errors in identity verification. Furthermore, the integration of advanced technologies may lead to the development of more sophisticated identity solutions, catering to the evolving needs of citizens. This trend indicates a dynamic shift in the digital identity landscape, positioning the market for substantial growth.

Public Awareness and Acceptance of Digital Identity Solutions

Public awareness and acceptance of digital identity solutions are critical factors influencing the digital identity-in-government-sector market. As citizens become more informed about the benefits of digital identities, such as convenience and security, the demand for these solutions is likely to increase. In Canada, educational campaigns and outreach initiatives by government agencies aim to enhance understanding and trust in digital identity systems. This growing acceptance is expected to drive higher adoption rates, as citizens recognize the advantages of streamlined access to government services. The market may witness a shift in public perception, leading to a more favorable environment for the implementation of digital identity solutions. Consequently, this trend could significantly impact the growth trajectory of the digital identity-in-government-sector market.