Rising Cybersecurity Threats

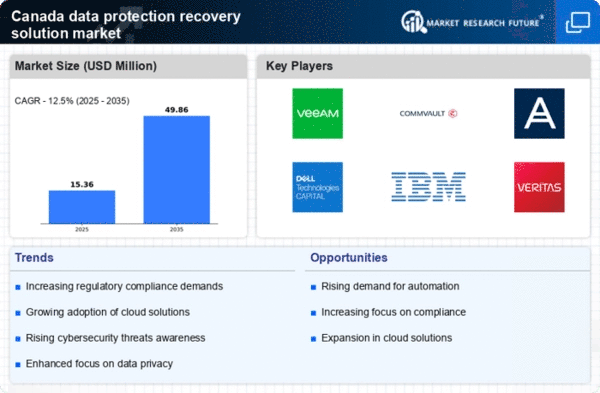

The data protection-recovery-solution market is experiencing heightened demand due to the increasing frequency and sophistication of cyberattacks in Canada. Organizations are investing significantly in data protection measures to safeguard sensitive information. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually, prompting a shift towards comprehensive data recovery solutions. This trend indicates that companies are prioritizing investments in robust data protection strategies to mitigate risks associated with data breaches and ransomware attacks. As a result, the market is likely to see a surge in innovative solutions designed to enhance data security and recovery capabilities, reflecting a proactive approach to cybersecurity.

Growing Data Volume and Complexity

The data protection-recovery-solution market is significantly impacted by the exponential growth of data generated by Canadian businesses. As organizations increasingly rely on digital platforms, the volume of data continues to expand, leading to complexities in data management. In 2025, it is projected that the total data generated in Canada will exceed 30 zettabytes. This surge necessitates sophisticated data protection and recovery solutions capable of handling large volumes of diverse data types. Companies are seeking solutions that can efficiently back up, restore, and manage data across various environments, including on-premises and cloud infrastructures, thereby driving innovation and competition within the market.

Regulatory Compliance Requirements

The data protection-recovery-solution market is influenced by stringent regulatory frameworks in Canada, such as the Personal Information Protection and Electronic Documents Act (PIPEDA). Organizations are compelled to comply with these regulations, which mandate the protection of personal data. Non-compliance can result in hefty fines, reaching up to $100,000 for individuals and $10 million for organizations. Consequently, businesses are increasingly adopting data protection solutions to ensure compliance and avoid potential penalties. This regulatory landscape is driving the demand for advanced recovery solutions that not only protect data but also facilitate compliance audits and reporting, thereby enhancing the overall market growth.

Increased Awareness of Data Privacy

The data protection recovery solution market As individuals become more conscious of their data rights, organizations are compelled to adopt transparent data protection practices. This shift is leading to a demand for solutions that not only protect data but also provide clear visibility into data handling processes. In 2025, it is anticipated that 70% of Canadian consumers will prioritize data privacy when choosing service providers. Consequently, businesses are investing in data recovery solutions that enhance trust and demonstrate a commitment to safeguarding personal information, thereby fostering customer loyalty and market growth.

Technological Advancements in Data Solutions

The data protection-recovery-solution market is witnessing rapid technological advancements that are reshaping the landscape of data management in Canada. Innovations such as blockchain technology, advanced encryption methods, and automated recovery processes are becoming increasingly prevalent. These technologies enhance the security and efficiency of data protection solutions, making them more appealing to organizations. In 2025, it is expected that the adoption of AI-driven data recovery solutions will increase by 40%, as businesses seek to leverage automation for faster recovery times and reduced operational costs. This trend indicates a shift towards more sophisticated and effective data protection strategies, driving growth in the market.