Growing Financial Literacy and Awareness

The Canada buy now pay later market is also being shaped by a growing emphasis on financial literacy and consumer awareness. As Canadians become more informed about their financial options, there is an increasing understanding of the benefits and risks associated with buy now pay later services. Educational initiatives and resources aimed at enhancing financial literacy are gaining traction, empowering consumers to make informed decisions regarding their payment choices. This heightened awareness may lead to a more discerning consumer base that actively seeks out buy now pay later options that align with their financial goals. Consequently, this trend is likely to drive growth within the Canada buy now pay later market, as consumers become more proactive in managing their finances.

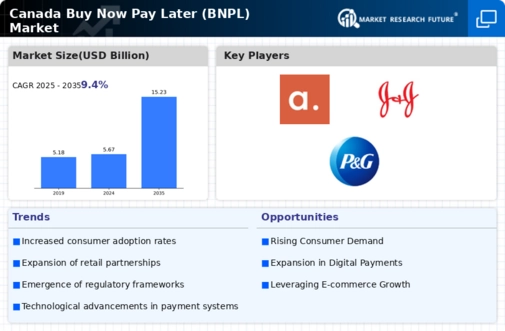

Expansion of E-commerce and Digital Shopping

The Canada buy now pay later market is significantly influenced by the rapid expansion of e-commerce and digital shopping platforms. As more Canadians turn to online shopping, the integration of buy now pay later options has become a strategic necessity for retailers. Data indicates that online sales in Canada have increased by over 30% in recent years, with a substantial portion of these transactions incorporating buy now pay later solutions. This trend not only enhances the shopping experience for consumers but also boosts conversion rates for retailers, as offering flexible payment options can reduce cart abandonment. The synergy between e-commerce growth and buy now pay later services is likely to continue shaping the landscape of the Canada buy now pay later market, fostering a more seamless and consumer-friendly shopping environment.

Regulatory Environment and Consumer Protection

The regulatory environment surrounding the Canada buy now pay later market is evolving, with increasing scrutiny from government bodies aimed at consumer protection. Recent discussions among policymakers have focused on ensuring transparency in terms of fees and interest rates associated with buy now pay later services. This regulatory attention may lead to the establishment of clearer guidelines and standards, which could enhance consumer trust in these financial products. As the industry adapts to these regulatory changes, it is likely that providers will need to implement more robust compliance measures, potentially reshaping their business models. This evolving landscape may ultimately foster a more sustainable and responsible Canada buy now pay later market, benefiting consumers and providers alike.

Technological Advancements in Payment Solutions

Technological advancements play a pivotal role in the evolution of the Canada buy now pay later market. Innovations in mobile payment technology, artificial intelligence, and data analytics are enhancing the efficiency and security of buy now pay later services. For instance, many providers are leveraging AI to assess creditworthiness in real-time, allowing for quicker approvals and a more personalized consumer experience. Furthermore, the rise of mobile wallets and contactless payment methods has facilitated the integration of buy now pay later options into everyday transactions. As technology continues to advance, it is expected that the Canada buy now pay later market will witness further enhancements in service delivery, ultimately benefiting both consumers and merchants alike.

Increased Consumer Demand for Flexible Payment Options

The Canada buy now pay later market is experiencing a notable surge in consumer demand for flexible payment solutions. This trend is particularly pronounced among younger demographics, who prioritize convenience and financial flexibility. According to recent surveys, approximately 40% of Canadian consumers express a preference for buy now pay later options over traditional credit methods. This shift indicates a growing acceptance of alternative financing solutions, which are perceived as more manageable and less burdensome. As consumers increasingly seek to avoid high-interest credit cards, the buy now pay later model offers an appealing alternative, allowing them to make purchases without immediate financial strain. Consequently, this heightened demand is likely to drive further innovation and competition within the Canada buy now pay later market, as providers strive to meet the evolving needs of consumers.