Government Support and Funding

The Canada artificial intelligence in manufacturing market benefits from substantial government support and funding initiatives. The Canadian government has recognized the potential of AI to enhance productivity and competitiveness in manufacturing. Programs such as the Strategic Innovation Fund and the Industrial Research Assistance Program provide financial assistance to companies adopting AI technologies. In 2023, the government allocated over CAD 1 billion to support AI research and development, which is expected to bolster the capabilities of Canadian manufacturers. This financial backing not only encourages innovation but also facilitates collaboration between academia and industry, fostering a robust ecosystem for AI integration in manufacturing processes.

Advancements in AI Technologies

The rapid advancements in AI technologies are significantly influencing the Canada artificial intelligence in manufacturing market. Innovations in areas such as natural language processing, computer vision, and robotics are enabling manufacturers to implement more sophisticated AI solutions. These technologies facilitate real-time data analysis, automate complex tasks, and improve overall operational efficiency. As of 2025, it is projected that investments in AI technologies within the manufacturing sector will exceed CAD 2 billion, reflecting the growing recognition of AI's potential to transform manufacturing processes and drive competitive advantage.

Increased Focus on Supply Chain Resilience

The Canada artificial intelligence in manufacturing market is witnessing an increased focus on supply chain resilience, driven by the need for greater efficiency and adaptability. AI technologies are being leveraged to enhance supply chain visibility, optimize inventory management, and predict demand fluctuations. This trend is particularly relevant in the context of global supply chain disruptions, where AI can provide manufacturers with the tools to respond swiftly to changing market conditions. By 2025, it is anticipated that AI-driven supply chain solutions will account for over 30% of the total manufacturing technology investments in Canada, underscoring the critical role of AI in building resilient supply chains.

Workforce Transformation and Skills Development

The integration of AI in the Canada artificial intelligence in manufacturing market necessitates a transformation of the workforce. As traditional manufacturing roles evolve, there is a growing emphasis on reskilling and upskilling employees to work alongside AI technologies. Industry stakeholders are increasingly investing in training programs to equip workers with the necessary skills to thrive in an AI-driven environment. Reports suggest that by 2026, approximately 50% of manufacturing jobs in Canada will require advanced digital skills, highlighting the importance of workforce development in maximizing the benefits of AI adoption.

Growing Demand for Smart Manufacturing Solutions

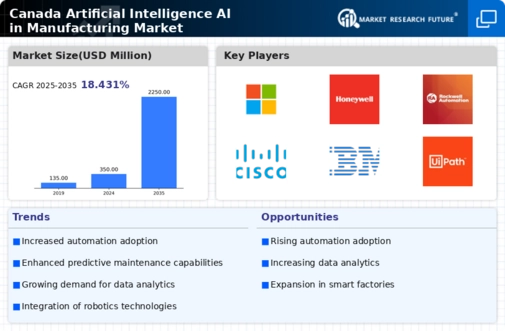

The demand for smart manufacturing solutions is rapidly increasing within the Canada artificial intelligence in manufacturing market. As manufacturers seek to optimize operations, reduce costs, and enhance product quality, AI technologies such as machine learning and predictive analytics are becoming essential. According to recent data, the market for smart manufacturing in Canada is projected to grow at a compound annual growth rate of 15% over the next five years. This trend indicates a shift towards more automated and data-driven manufacturing processes, where AI plays a pivotal role in decision-making and operational efficiency.