Emergence of Smart Cities

The concept of smart cities is gaining traction in Canada, with municipalities increasingly investing in technology to improve urban living. The integration of 5G systems is pivotal to the development of smart city initiatives, as it enables real-time data collection and analysis, enhancing services such as traffic management, public safety, and energy efficiency. Cities like Toronto and Vancouver are at the forefront of this movement, implementing 5G infrastructure to support various smart applications. This trend is expected to drive the Canada 5G system integration market, as local governments and private enterprises collaborate to create interconnected urban environments. The potential for improved quality of life and operational efficiency in cities presents a compelling case for investment in 5G system integration.

Growth of IoT Applications

The proliferation of Internet of Things (IoT) devices in Canada is significantly influencing the 5G system integration market. As more devices become interconnected, the demand for robust and efficient network solutions increases. The Canada 5G system integration market is poised to benefit from this trend, as 5G technology offers the necessary bandwidth and low latency required for IoT applications. Industries such as agriculture, healthcare, and manufacturing are exploring IoT solutions to enhance productivity and operational efficiency. For instance, smart agriculture initiatives are utilizing IoT sensors to monitor crop health and optimize resource usage. This growing reliance on IoT is likely to drive further investment in 5G system integration, as businesses seek to leverage the advantages of advanced connectivity.

Government Initiatives and Policies

The Canadian government has been actively promoting the development of the 5G system integration market through various initiatives and policies. The Innovation, Science and Economic Development Canada (ISED) has outlined a comprehensive strategy to enhance the telecommunications infrastructure, which includes the allocation of spectrum for 5G services. This proactive approach is expected to stimulate investments in the Canada 5G system integration market, as companies seek to align with government objectives. Furthermore, the government's commitment to ensuring equitable access to high-speed internet across urban and rural areas indicates a potential increase in demand for integrated 5G solutions. As a result, the Canada 5G system integration market is likely to experience growth driven by these supportive policies and initiatives.

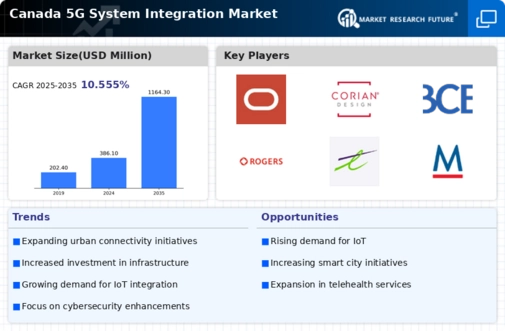

Competitive Landscape and Market Dynamics

The competitive landscape of the Canada 5G system integration market is evolving, with numerous players vying for market share. Major telecommunications companies are investing heavily in 5G infrastructure, while smaller firms are emerging with innovative solutions tailored to specific industry needs. This dynamic environment fosters collaboration and partnerships, as companies seek to enhance their service offerings. The Canada 5G system integration market is characterized by rapid technological advancements, which compel firms to adapt and innovate continuously. As competition intensifies, there is a potential for price reductions and improved service quality, benefiting consumers and businesses alike. This competitive pressure is likely to stimulate further growth in the market, as companies strive to differentiate themselves through superior integration solutions.

Rising Demand for High-Speed Connectivity

The demand for high-speed connectivity in Canada is escalating, driven by the increasing reliance on digital services across various sectors. Businesses and consumers alike are seeking faster and more reliable internet connections to support activities such as remote work, online education, and streaming services. According to recent data, approximately 90% of Canadians have access to high-speed internet, yet there remains a significant push to enhance this connectivity further. This growing demand is likely to propel the Canada 5G system integration market, as service providers and technology firms work to deliver advanced solutions that meet consumer expectations. The integration of 5G technology is seen as a crucial step in addressing these connectivity needs, thereby fostering market growth.