Rise of Content Creation

The surge in content creation across various platforms is a significant driver for the camcorder Market. With the proliferation of social media and video-sharing platforms, individuals and businesses are increasingly investing in high-quality camcorders to produce engaging content. This trend is reflected in the rising number of YouTube channels and streaming services that prioritize video quality. Market data suggests that the demand for camcorders among content creators has increased by approximately 30% in the past year alone. This shift indicates a growing recognition of the importance of professional-grade equipment in achieving high production values. As more people seek to establish their online presence, the Camcorder Market is poised to benefit from this expanding consumer base, which values quality and versatility in video recording.

Growing Interest in Vlogging

The increasing interest in vlogging is a notable driver for the Camcorder Market. Vloggers require equipment that is portable, user-friendly, and capable of producing high-quality video content. As a result, camcorders designed specifically for vlogging, featuring lightweight designs and advanced audio capabilities, are gaining traction among consumers. Market analysis indicates that the vlogging segment has seen a growth rate of approximately 25% in recent years, highlighting the demand for specialized camcorders. This trend is likely to continue as more individuals seek to share their experiences and stories through video. Consequently, the Camcorder Market is expected to evolve, with manufacturers focusing on creating products that cater to the unique needs of vloggers, thereby enhancing their market presence.

Increased Demand for Live Streaming

The growing popularity of live streaming is significantly influencing the Camcorder Market. As more individuals and organizations turn to live broadcasts for events, gaming, and educational purposes, the need for reliable and high-quality camcorders has surged. Recent statistics indicate that the live streaming market is expected to reach a valuation of over 70 billion dollars by 2027, which directly correlates with the demand for camcorders equipped with live streaming capabilities. Features such as built-in Wi-Fi and real-time streaming options are becoming essential for consumers. This trend suggests that manufacturers in the Camcorder Market must adapt to meet the evolving needs of users who prioritize connectivity and ease of use in their video production tools.

Technological Advancements in Camcorders

The Camcorder Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as 4K and 8K video recording capabilities are becoming standard features, enhancing the quality of video content. Additionally, the integration of artificial intelligence in camcorders allows for improved autofocus and image stabilization, which are crucial for both amateur and professional videographers. According to recent data, the market for camcorders with advanced features is projected to grow at a compound annual growth rate of 5.2% over the next five years. This growth is indicative of consumer demand for high-quality video production tools, which are essential in a world increasingly focused on visual storytelling. As technology continues to evolve, the Camcorder Market is likely to see further innovations that cater to the needs of content creators.

Emerging Markets and Consumer Accessibility

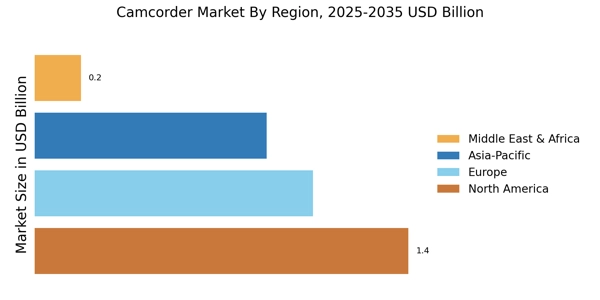

Emerging markets are playing a crucial role in shaping the Camcorder Market. As disposable incomes rise in various regions, more consumers are gaining access to video recording technology. This trend is particularly evident in countries where social media usage is on the rise, leading to increased demand for camcorders. Market data suggests that sales in emerging markets have grown by approximately 15% over the past year, driven by a younger demographic eager to create and share content. This shift indicates a potential for manufacturers to expand their reach and tailor products to meet the specific needs of these consumers. As accessibility improves, the Camcorder Market is likely to see a diversification of its product offerings, catering to a broader audience.