Government Incentives and Policies

Government incentives and policies play a significant role in shaping the Cadmium Telluride Market. Many countries have implemented favorable regulations and financial incentives to encourage the adoption of solar energy technologies. For instance, tax credits, rebates, and feed-in tariffs have been introduced to stimulate investment in solar projects. These initiatives not only lower the financial barriers for consumers but also promote research and development in cadmium telluride technology. As these policies continue to evolve, they are expected to further drive the growth of the Cadmium Telluride Market.

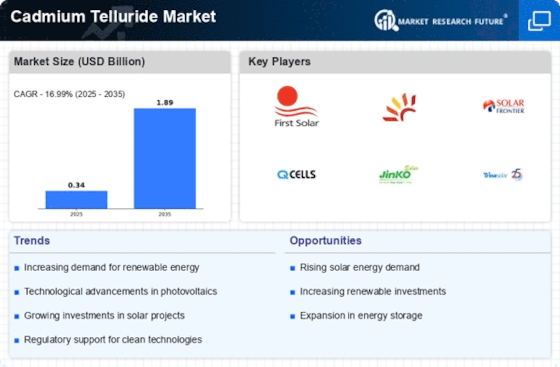

Rising Adoption of Renewable Energy Sources

The increasing emphasis on renewable energy sources is a pivotal driver for the Cadmium Telluride Market. Governments and organizations are actively promoting solar energy as a sustainable alternative to fossil fuels. This shift is evidenced by the growing number of solar installations, which have surged significantly in recent years. In 2023, the capacity of solar photovoltaic systems reached approximately 1,200 GW, with a substantial portion utilizing cadmium telluride technology. This trend is likely to continue, as the demand for clean energy solutions intensifies, thereby bolstering the Cadmium Telluride Market.

Growing Awareness of Environmental Sustainability

The rising awareness of environmental sustainability is a driving force behind the Cadmium Telluride Market. As consumers become more conscious of their carbon footprints, there is a growing preference for eco-friendly energy solutions. Cadmium telluride solar panels, known for their lower environmental impact during production and disposal compared to other technologies, are gaining traction. This shift in consumer behavior is likely to stimulate demand for cadmium telluride products, as individuals and businesses alike seek to align their energy choices with sustainable practices, thereby fostering growth in the Cadmium Telluride Market.

Cost-Effectiveness of Cadmium Telluride Technology

The cost-effectiveness of cadmium telluride technology is a crucial factor driving the Cadmium Telluride Market. Compared to traditional silicon-based solar cells, cadmium telluride solar panels offer lower production costs and higher efficiency rates. The average cost of cadmium telluride modules has decreased by nearly 30% over the past five years, making them an attractive option for both residential and commercial applications. This economic advantage is likely to enhance the market's appeal, as more consumers and businesses seek affordable solar energy solutions, thereby propelling the Cadmium Telluride Market forward.

Technological Innovations in Solar Panel Efficiency

Technological innovations are transforming the landscape of the Cadmium Telluride Market. Recent advancements in manufacturing processes and materials have led to significant improvements in the efficiency of cadmium telluride solar panels. For example, the introduction of new deposition techniques has enhanced the light absorption capabilities of these panels, resulting in higher energy conversion rates. As efficiency continues to improve, the attractiveness of cadmium telluride technology is likely to increase, encouraging wider adoption across various sectors and contributing to the expansion of the Cadmium Telluride Market.