Automotive Sector Growth

The automotive industry plays a crucial role in the Cable Assembly Market, particularly with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). As automakers increasingly integrate complex electronic systems into their vehicles, the demand for high-quality cable assemblies is expected to rise significantly. In 2025, the automotive sector is anticipated to contribute a considerable share to the cable assembly market, with projections indicating a growth rate of around 7% per year. This growth is likely driven by the need for reliable connections that can withstand the rigors of automotive environments, thereby pushing manufacturers to focus on durability and performance in their cable assembly solutions.

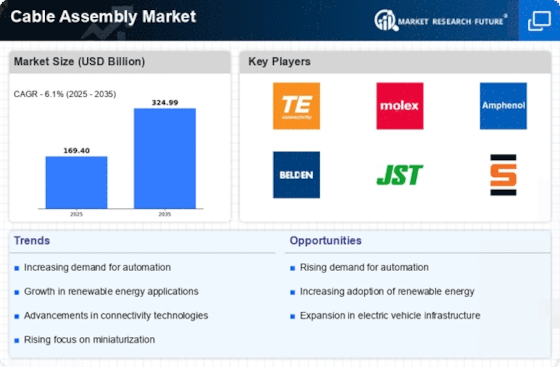

Rising Demand in Electronics

The Cable Assembly Market is experiencing a notable surge in demand, particularly driven by the increasing production of electronic devices. As consumer electronics continue to evolve, the need for efficient and reliable cable assemblies becomes paramount. In 2025, the electronics sector is projected to account for a substantial portion of the cable assembly market, with estimates suggesting a growth rate of approximately 6% annually. This trend is further fueled by advancements in technology, which necessitate more sophisticated cable solutions to support high-speed data transmission and connectivity. Consequently, manufacturers are compelled to innovate and enhance their product offerings to meet the evolving requirements of the electronics industry.

Industrial Automation and Robotics

The rise of industrial automation and robotics is significantly influencing the Cable Assembly Market. As industries increasingly adopt automated solutions to enhance efficiency and productivity, the demand for specialized cable assemblies that can support these technologies is on the rise. In 2025, the industrial automation sector is projected to grow at a rate of approximately 8%, creating a substantial market for cable assemblies designed for robotic applications. This trend indicates a shift towards more complex and integrated cable solutions that can withstand harsh industrial environments while ensuring reliable performance. Manufacturers are thus encouraged to innovate and adapt their offerings to meet the specific needs of the automation industry.

Renewable Energy Sector Development

The development of the renewable energy sector is emerging as a significant driver for the Cable Assembly Market. As countries increasingly invest in sustainable energy solutions, the demand for cable assemblies in solar, wind, and other renewable energy applications is expected to grow. In 2025, the renewable energy sector is likely to witness a growth rate of around 9%, which will consequently boost the demand for high-quality cable assemblies that can endure environmental challenges. This trend suggests that manufacturers must focus on creating durable and efficient cable solutions tailored for renewable energy applications, thereby positioning themselves favorably within this expanding market.

Telecommunications Infrastructure Expansion

The expansion of telecommunications infrastructure is a pivotal driver for the Cable Assembly Market. With the ongoing rollout of 5G networks, there is an increasing requirement for robust and efficient cable assemblies to support high-speed data transmission. In 2025, investments in telecommunications infrastructure are expected to reach unprecedented levels, with estimates suggesting a growth of over 10% in related sectors. This expansion necessitates the development of specialized cable assemblies that can handle the demands of modern communication technologies. As a result, manufacturers are likely to prioritize innovation and quality in their cable assembly products to cater to the evolving needs of the telecommunications sector.