Geopolitical Tensions

Geopolitical tensions around the globe are significantly influencing the Global c4isr Industry. Nations are compelled to enhance their surveillance and reconnaissance capabilities in response to regional conflicts and security threats. For instance, the ongoing tensions in Eastern Europe and the South China Sea have prompted countries to invest in advanced C4ISR Market systems to maintain strategic advantages. This heightened focus on national security is likely to sustain the market's growth trajectory, with a projected CAGR of 4.01% from 2025 to 2035, as countries prioritize investments in defense technologies.

Increasing Defense Budgets

The Global C4ISR Industry is experiencing growth due to rising defense budgets across various nations. Countries are investing heavily in advanced military technologies to enhance their operational capabilities. For instance, the United States has allocated substantial funds for modernization programs, which include C4ISR Market systems. This trend is not limited to the U.S.; nations such as India and China are also increasing their defense expenditures, which is projected to contribute to the Global C4ISR Market reaching 119.8 USD Billion in 2024. This escalation in spending reflects a broader commitment to national security and technological advancement.

Technological Advancements

Rapid technological advancements are driving the Global C4ISR Industry, as innovations in artificial intelligence, machine learning, and data analytics enhance the effectiveness of command, control, communications, computers, intelligence, surveillance, and reconnaissance systems. These technologies enable real-time data processing and improved decision-making capabilities. For example, the integration of AI in surveillance systems allows for quicker identification of threats, thereby increasing operational efficiency. As these technologies continue to evolve, they are expected to play a crucial role in the market's growth, potentially leading to a market valuation of 184.6 USD Billion by 2035.

Emerging Markets and Global Partnerships

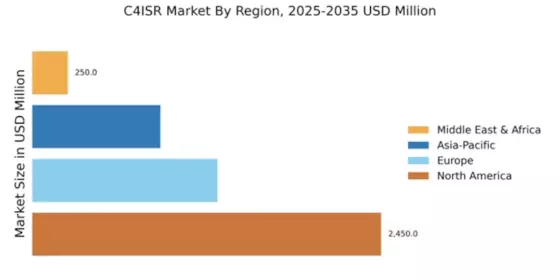

Emerging markets are playing a pivotal role in the expansion of the Global C4ISR Industry. Countries in Asia, the Middle East, and Africa are increasingly investing in C4ISR Market capabilities to strengthen their defense infrastructures. Additionally, global partnerships and collaborations between nations and defense contractors are fostering the development of innovative C4ISR Market solutions. For instance, joint exercises and technology-sharing agreements are enhancing the capabilities of allied forces. This trend is likely to contribute to the overall growth of the market, as these regions seek to modernize their defense systems and improve interoperability.

Demand for Enhanced Situational Awareness

The demand for enhanced situational awareness is a critical driver of the Global C4ISR Industry. Military and defense organizations are increasingly recognizing the importance of real-time information for effective decision-making and operational success. This demand is evident in the adoption of integrated C4ISR Market systems that provide comprehensive battlefield awareness. For example, NATO forces utilize advanced C4ISR Market technologies to improve coordination and response times during operations. As the need for situational awareness continues to grow, the market is expected to expand, reflecting the necessity for advanced systems that can process and analyze vast amounts of data.