North America : Market Leader in BPM Solutions

North America continues to lead the Business Process Management (BPM) Solutions Market, holding a significant share of 7.75 in 2025. The region's growth is driven by rapid digital transformation, increased automation, and a strong focus on operational efficiency. Regulatory support for technology adoption further fuels demand, as organizations seek to streamline processes and enhance productivity.

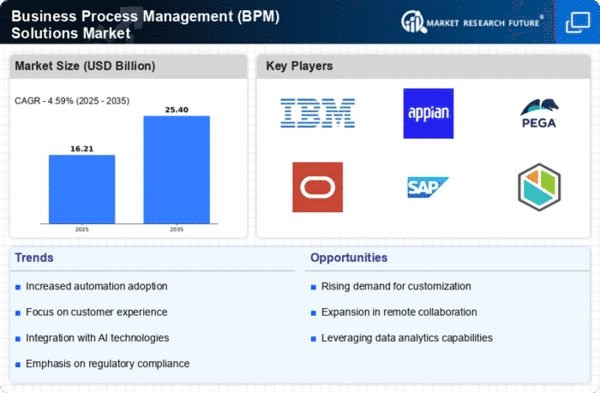

The competitive landscape is robust, with key players like IBM, Appian, and Oracle dominating the market. The U.S. is the primary contributor, benefiting from a mature technology ecosystem and substantial investments in BPM solutions. Companies are increasingly adopting cloud-based BPM tools to improve scalability and flexibility, ensuring North America's continued leadership in this sector.

Europe : Emerging BPM Solutions Hub

Europe's Business Process Management (BPM) Solutions Market is poised for growth, with a market size of 4.65 in 2025. The region is experiencing a surge in demand for BPM solutions driven by regulatory compliance, digital transformation initiatives, and the need for enhanced customer experiences. European organizations are increasingly focusing on integrating BPM with emerging technologies like AI and IoT to optimize operations and drive innovation.

Leading countries such as Germany, the UK, and France are at the forefront of this growth, with a competitive landscape featuring major players like SAP and Bizagi. The European market is characterized by a strong emphasis on data protection regulations, which influence BPM adoption strategies. As organizations navigate these regulations, the demand for compliant BPM solutions is expected to rise significantly.

Asia-Pacific : Rapidly Growing BPM Market

The Asia-Pacific region is witnessing a rapid expansion in the Business Process Management (BPM) Solutions Market, with a projected size of 2.85 in 2025. This growth is fueled by increasing investments in digital technologies, a rising number of startups, and a growing emphasis on process optimization across various industries. Governments in the region are also promoting digital initiatives, which act as catalysts for BPM adoption.

Countries like India and China are leading the charge, with a vibrant competitive landscape that includes local and international players such as Kissflow and Zoho. The region's diverse market demands tailored BPM solutions that cater to specific industry needs, driving innovation and competition. As organizations seek to enhance efficiency and agility, the BPM market in Asia-Pacific is set for significant growth.

Middle East and Africa : Emerging BPM Solutions Frontier

The Middle East and Africa (MEA) region is emerging as a frontier for Business Process Management (BPM) Solutions, with a market size of 0.25 in 2025. The growth in this region is primarily driven by increasing digitalization efforts, government initiatives to enhance business processes, and a growing awareness of the benefits of BPM solutions. Organizations are increasingly recognizing the need for efficient process management to remain competitive in a rapidly evolving market.

Countries like South Africa and the UAE are leading the BPM adoption, supported by a competitive landscape that includes both local and international players. The presence of key players is gradually increasing, as businesses seek to leverage BPM solutions to improve operational efficiency and customer satisfaction. The MEA region is poised for growth as it embraces digital transformation.