Rising Steel Production

The Bulk Ferroalloys Market is experiencing a surge in demand due to the increasing production of steel. As steel remains a fundamental material in construction and manufacturing, the need for ferroalloys, which enhance the properties of steel, is likely to grow. In 2025, steel production is projected to reach approximately 1.9 billion metric tons, necessitating a corresponding rise in ferroalloy consumption. This trend indicates that the Bulk Ferroalloys Market will benefit from the expanding steel sector, as ferroalloys such as ferrosilicon and ferromanganese are essential for producing high-quality steel. Furthermore, the ongoing urbanization and infrastructure development projects across various regions are expected to further bolster the demand for steel, thereby positively impacting the Bulk Ferroalloys Market.

Infrastructure Development

The Bulk Ferroalloys Market is poised to gain momentum from extensive infrastructure development initiatives. Governments and private sectors are investing heavily in infrastructure projects, including roads, bridges, and buildings, which require substantial amounts of steel. As a result, the demand for ferroalloys, which are critical in steel production, is anticipated to rise. In 2025, the construction sector is expected to account for a significant portion of the steel demand, with estimates suggesting that infrastructure projects could drive a 5% increase in ferroalloy consumption. This trend underscores the importance of the Bulk Ferroalloys Market in supporting the growth of the construction sector, as the quality and durability of steel are enhanced through the use of ferroalloys.

Growing Demand from Emerging Economies

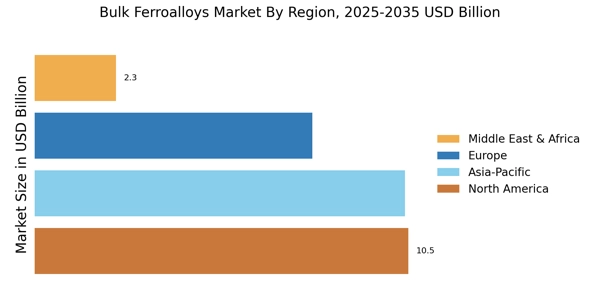

Emerging economies are becoming increasingly significant players in the Bulk Ferroalloys Market. Countries such as India, Brazil, and Indonesia are witnessing rapid industrialization and urbanization, leading to heightened demand for steel and, consequently, ferroalloys. In 2025, it is estimated that these regions will contribute to over 30% of the total ferroalloy consumption, driven by their expanding manufacturing sectors. This trend suggests that the Bulk Ferroalloys Market will need to adapt to the specific requirements of these markets, potentially leading to increased production capacities and tailored product offerings. The growth in these economies presents both challenges and opportunities for stakeholders in the Bulk Ferroalloys Market.

Technological Innovations in Production

Technological advancements in the production of ferroalloys are likely to play a crucial role in shaping the Bulk Ferroalloys Market. Innovations such as improved smelting techniques and energy-efficient processes are being adopted to enhance production efficiency and reduce costs. For instance, the implementation of electric arc furnaces has shown potential in increasing the yield of ferroalloys while minimizing environmental impact. As these technologies become more prevalent, the Bulk Ferroalloys Market may witness a shift towards more sustainable production methods. This could lead to a competitive advantage for manufacturers who adopt these innovations, potentially increasing their market share and profitability in the evolving landscape of the ferroalloys sector.

Environmental Regulations and Sustainability

The Bulk Ferroalloys Market is increasingly influenced by stringent environmental regulations and a growing emphasis on sustainability. As governments worldwide implement policies aimed at reducing carbon emissions, the ferroalloy production process is under scrutiny. Manufacturers are being urged to adopt cleaner technologies and practices to comply with these regulations. In 2025, it is anticipated that companies prioritizing sustainable practices will gain a competitive edge in the Bulk Ferroalloys Market. This shift towards sustainability may also drive innovation in the development of eco-friendly ferroalloys, which could attract environmentally conscious consumers. Consequently, the Bulk Ferroalloys Market is likely to evolve, focusing on sustainable production methods while meeting the demands of a changing regulatory landscape.