North America : Market Leader in Services

North America leads the Building Systems Maintenance and Repair Services Market, holding a significant share of 92.5% in 2024. The growth is driven by increasing urbanization, stringent building codes, and a rising focus on energy efficiency. Regulatory frameworks promoting sustainable practices further catalyze demand for maintenance services, ensuring compliance and enhancing operational efficiency.

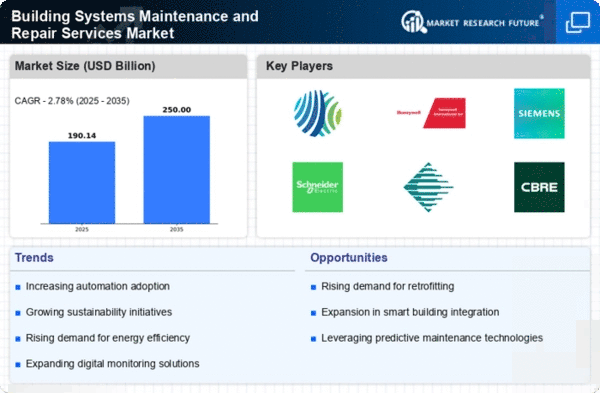

The competitive landscape is robust, with key players like Johnson Controls, Honeywell International, and CBRE Group dominating the market. The U.S. is the primary contributor, supported by advanced infrastructure and technological innovations. Companies are increasingly adopting smart building technologies, enhancing service delivery and customer satisfaction, thereby solidifying their market positions.

Europe : Emerging Market Dynamics

Europe's Building Systems Maintenance and Repair Services Market is valued at €50.0 billion, reflecting a growing demand for efficient building management solutions. Factors such as increasing regulatory requirements for energy efficiency and sustainability are driving market growth. The European Union's Green Deal aims to make buildings more energy-efficient, which is expected to further boost the demand for maintenance services across the region.

Leading countries include Germany, France, and the UK, where major players like Siemens and Schneider Electric are actively expanding their service offerings. The competitive landscape is characterized by a mix of local and international firms, focusing on innovative solutions to meet evolving customer needs. The presence of established companies enhances market stability and fosters healthy competition.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific region, with a market size of $35.0 billion, is witnessing rapid growth in the Building Systems Maintenance and Repair Services Market. Urbanization, increasing disposable incomes, and a growing focus on infrastructure development are key drivers. Governments are implementing regulations to improve building safety and energy efficiency, which is expected to further stimulate market demand in the coming years.

Countries like China, Japan, and India are leading the charge, with significant investments in smart building technologies. The competitive landscape features both local and international players, including KONE and Honeywell, who are leveraging technology to enhance service delivery. The region's diverse market presents numerous opportunities for growth, particularly in urban centers where infrastructure is rapidly evolving.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, valued at $7.5 billion, is gradually emerging in the Building Systems Maintenance and Repair Services Market. Rapid urbanization, coupled with increasing investments in infrastructure, is driving demand for maintenance services. Governments are focusing on enhancing building safety and energy efficiency, which is expected to catalyze market growth in the coming years.

Leading countries in this region include the UAE and South Africa, where significant projects are underway. The competitive landscape is evolving, with both local firms and international players seeking to establish a foothold. Companies are increasingly adopting innovative technologies to improve service efficiency and customer satisfaction, positioning themselves for future growth.