Regulatory Support for Energy Efficiency

Government regulations promoting energy efficiency are influencing the Global Building Panels Market Industry positively. Many countries are implementing stricter building codes that require the use of energy-efficient materials in construction. These regulations encourage builders to adopt building panels that enhance thermal insulation and reduce energy consumption. For example, the adoption of energy-efficient panels can lead to lower operational costs for building owners. As regulatory frameworks continue to evolve, they are likely to drive further demand for innovative building panel solutions, thereby expanding the market.

Growing Demand for Sustainable Construction

The Global Building Panels Market Industry is experiencing a notable shift towards sustainable construction practices. This trend is driven by increasing awareness of environmental issues and the need for energy-efficient building materials. Building panels made from recycled or renewable materials are gaining traction, as they contribute to reduced carbon footprints. For instance, the use of insulated panels can lead to significant energy savings, aligning with global sustainability goals. As a result, the market is projected to reach 76.9 USD Billion in 2024, reflecting a growing preference for eco-friendly solutions in construction.

Urbanization and Infrastructure Development

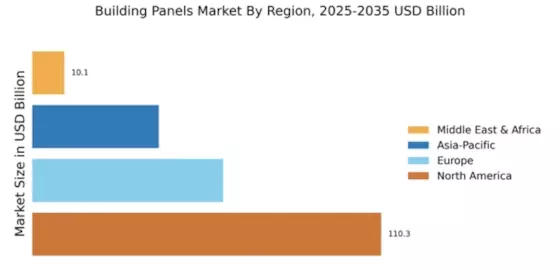

Rapid urbanization and ongoing infrastructure development are significant drivers of the Global Building Panels Market Industry. As populations in urban areas continue to grow, there is an increasing demand for residential and commercial buildings. Building panels, known for their lightweight and durable properties, are ideal for meeting this demand efficiently. Governments worldwide are investing in infrastructure projects, further propelling the need for innovative building solutions. This trend is expected to sustain a compound annual growth rate of 3.9% from 2025 to 2035, indicating robust growth in the market.

Technological Advancements in Panel Manufacturing

Innovations in manufacturing technologies are reshaping the Global Building Panels Market Industry. Advanced techniques such as 3D printing and automated production lines enhance efficiency and reduce costs. These technologies enable the production of customized building panels that meet specific architectural requirements. Furthermore, the integration of smart technologies into building panels, such as sensors for energy management, is becoming increasingly prevalent. This evolution not only improves the performance of building panels but also attracts investment in the sector, contributing to a projected market growth to 117.2 USD Billion by 2035.

Increasing Investment in Green Building Initiatives

The Global Building Panels Market Industry is benefiting from a surge in investment in green building initiatives. Organizations and governments are increasingly recognizing the long-term benefits of sustainable construction practices. This investment is reflected in the growing number of green building certifications and standards, which encourage the use of building panels that meet environmental criteria. The financial incentives associated with green building projects, such as tax breaks and grants, further stimulate market growth. As a result, the market is poised for expansion, driven by a collective commitment to sustainable development.