North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Building Electrical System Maintenance and MRO Services Market, holding a significant market share of 25.0 in 2024. The region's growth is driven by increasing infrastructure investments, stringent safety regulations, and a rising demand for energy-efficient solutions. Regulatory frameworks promoting sustainability and modernization of electrical systems further catalyze market expansion.

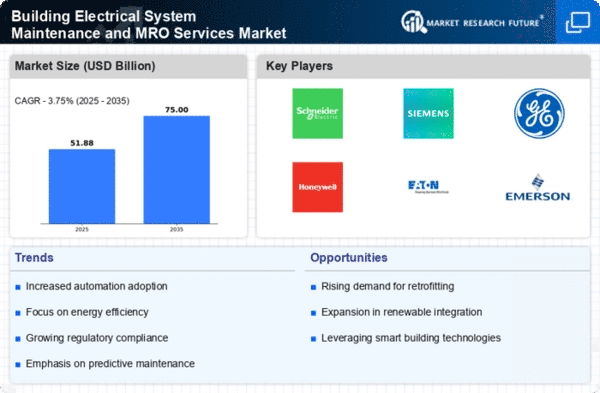

The competitive landscape in North America is robust, featuring key players such as General Electric, Honeywell, and Eaton. The U.S. stands out as the leading country, supported by advanced technological capabilities and a strong focus on innovation. The presence of major corporations ensures a dynamic market environment, fostering continuous improvements in service delivery and operational efficiency.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for Building Electrical System Maintenance and MRO Services, with a market size of 15.0 in 2024. The region's growth is fueled by increasing investments in renewable energy, smart building technologies, and compliance with stringent EU regulations aimed at enhancing energy efficiency. The European Green Deal and other initiatives are pivotal in shaping the market landscape, driving the adoption of advanced maintenance solutions.

Leading countries in Europe include Germany, France, and the UK, where major players like Siemens and Schneider Electric are actively enhancing their service offerings. The competitive environment is characterized by innovation and collaboration among industry leaders, ensuring that the region remains at the forefront of electrical system maintenance and MRO services.

Asia-Pacific : Rapidly Growing Market Segment

Asia-Pacific is emerging as a significant player in the Building Electrical System Maintenance and MRO Services Market, with a market size of 8.0 in 2024. The region's growth is driven by rapid urbanization, increasing industrialization, and a growing focus on infrastructure development. Government initiatives promoting smart cities and energy efficiency are also key factors contributing to market expansion, creating a favorable environment for MRO services.

Countries like China, India, and Japan are leading the charge, with a competitive landscape featuring both local and international players. Companies such as ABB and Rockwell Automation are expanding their presence, leveraging technological advancements to enhance service delivery. The region's diverse market dynamics present both challenges and opportunities for growth in the MRO sector.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually developing its Building Electrical System Maintenance and MRO Services Market, currently valued at 2.0 in 2024. The growth is primarily driven by increasing investments in infrastructure and energy projects, alongside a rising demand for efficient electrical systems. However, challenges such as regulatory hurdles and economic fluctuations can impact market stability and growth potential.

Leading countries in this region include the UAE and South Africa, where there is a growing presence of international players. Companies are focusing on establishing partnerships and localizing services to better cater to regional needs. The competitive landscape is evolving, with opportunities for growth as the region invests in modernization and sustainability initiatives.