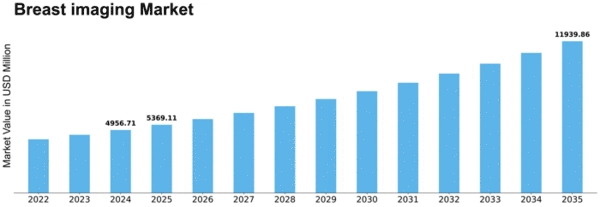

Breast Imaging Size

Breast imaging Market Growth Projections and Opportunities

The global breast imaging market is growing because more people are getting breast cancer, and there's increased awareness about finding it early. The number of older people is also going up, and there's more money being spent on researching and developing new ways to detect breast cancer. However, there are some challenges like the risks of radiation exposure and the breast imaging machines being expensive, which might slow down the market growth.

The breast imaging market is expanding worldwide due to the increased number of people facing breast cancer. Many efforts are being made to create awareness about the importance of detecting breast cancer early. This is crucial for better treatment outcomes. The growing population of older individuals is also contributing to the market growth, as breast cancer is more common among older age groups. Additionally, more money is being invested in research and development to find better ways of detecting and treating breast cancer. These factors combined are driving the expansion of the breast imaging market.

Despite the positive trends, there are challenges that could impact the market's growth. One concern is the potential risks associated with radiation exposure during breast imaging procedures. People are worried about the effects of radiation on their health. Another obstacle is the high cost of breast imaging systems. These machines are expensive, making it difficult for some healthcare facilities to afford them. The cost can be a barrier to providing accessible breast imaging services, particularly in regions with limited resources.

To overcome these challenges and ensure the continued growth of the breast imaging market, it's essential to address these concerns. Finding ways to reduce radiation exposure and making imaging procedures safer for patients is crucial. Additionally, efforts to make breast imaging technology more affordable and accessible will help in reaching a broader population. This might involve research and innovation in developing cost-effective imaging systems without compromising quality.

The rising prevalence of breast cancer is a major factor driving the growth of the global breast imaging market. Breast cancer is a significant health concern worldwide, and early detection is crucial for effective treatment. Various awareness programs and campaigns are helping people understand the importance of regular breast screenings, contributing to the increased demand for breast imaging services.

The ageing population is another factor influencing market growth. As people age, the risk of developing breast cancer increases. Therefore, the growing number of elderly individuals contributes to the overall rise in breast cancer cases, necessitating more extensive use of breast imaging technologies for diagnosis and monitoring.

Research and development (R&D) investments play a pivotal role in advancing breast imaging technologies. Ongoing efforts to enhance imaging modalities, develop more accurate diagnostic tools, and improve treatment planning contribute to the market's expansion. Innovations in breast imaging techniques can lead to more effective and efficient methods for detecting and managing breast cancer.

However, challenges such as radiation exposure risks pose concerns for patients undergoing breast imaging procedures. Addressing these concerns requires a focus on developing safer imaging technologies and adopting practices that minimize radiation exposure without compromising diagnostic accuracy. This is particularly important to ensure patient safety and enhance the overall acceptance of breast imaging procedures.

Additionally, the high cost associated with breast imaging systems remains a significant barrier to widespread adoption. Finding ways to make these technologies more cost-effective, without compromising quality, is essential for ensuring accessibility to breast imaging services, especially in regions with limited financial resources.

Leave a Comment