Growing Emphasis on Cybersecurity

The virtual networking market in Brazil is increasingly influenced by the growing emphasis on cybersecurity. With the rise in cyber threats, organizations are prioritizing the protection of their digital assets. Recent reports suggest that cyberattacks in Brazil have surged by over 30% in the past year, prompting businesses to invest in secure networking solutions. This heightened focus on cybersecurity is reshaping the virtual networking market, as companies seek platforms that not only facilitate communication but also ensure data protection. Consequently, vendors are likely to enhance their offerings by integrating advanced security features, thereby attracting organizations that prioritize safety in their networking solutions. This trend may lead to a more competitive landscape, as businesses strive to differentiate themselves through superior security measures.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the virtual networking market in Brazil. As companies navigate economic challenges, there is a growing need to optimize operational expenses. Recent surveys indicate that nearly 60% of Brazilian businesses are actively seeking cost-effective networking solutions to enhance their bottom line. This trend is particularly relevant in the virtual networking market, where organizations are exploring alternatives that provide high functionality at lower costs. The demand for affordable yet reliable networking tools is likely to stimulate innovation, as providers strive to deliver value-driven solutions. Additionally, the emphasis on cost efficiency may encourage businesses to adopt cloud-based networking services, which often offer scalable pricing models that align with varying organizational budgets.

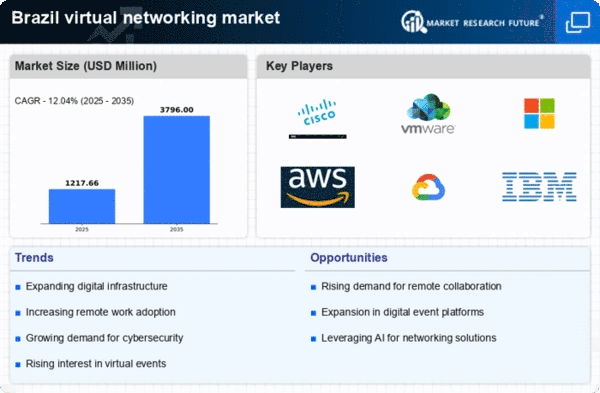

Investment in Digital Infrastructure

Brazil's commitment to enhancing its digital infrastructure significantly impacts the virtual networking market. The government has initiated various programs aimed at improving internet connectivity across urban and rural areas. Recent statistics indicate that internet penetration in Brazil has reached approximately 80%, with ongoing efforts to expand access further. This investment in digital infrastructure is crucial for the virtual networking market, as it enables businesses to leverage advanced networking solutions without the constraints of poor connectivity. Enhanced infrastructure not only supports existing virtual networking tools but also encourages the development of new technologies that can thrive in a more connected environment. As a result, the market is likely to witness increased adoption of innovative networking solutions that cater to the evolving needs of Brazilian enterprises.

Rising Demand for Flexible Work Solutions

The virtual networking market in Brazil experiences a notable surge in demand for flexible work solutions. As organizations increasingly adopt hybrid work models, the need for robust virtual networking tools becomes paramount. According to recent data, approximately 70% of Brazilian companies are implementing remote work policies, which necessitate reliable networking solutions. This shift not only enhances productivity but also fosters employee satisfaction. The virtual networking market is thus positioned to benefit from this trend, as businesses seek platforms that facilitate seamless communication and collaboration among remote teams. Furthermore, the emphasis on flexibility in work arrangements is likely to drive innovation within the market, leading to the development of more sophisticated networking solutions tailored to diverse organizational needs.

Expansion of E-commerce and Digital Services

The expansion of e-commerce and digital services in Brazil significantly influences the virtual networking market. As online shopping and digital transactions become increasingly prevalent, businesses require robust networking solutions to support their operations. Recent data indicates that e-commerce sales in Brazil have grown by over 25% in the last year, highlighting the need for reliable virtual networking tools. This growth presents a substantial opportunity for the virtual networking market, as companies seek to enhance their online presence and streamline their digital services. The demand for efficient networking solutions is likely to drive the development of platforms that cater specifically to e-commerce needs, such as secure payment processing and customer relationship management. Consequently, the market may witness a surge in innovative offerings designed to support the evolving landscape of digital commerce.